Last summer, as the first coronavirus lockdown lifted, millions of Brits were keen for a taste of freedom. With travel restrictions in place and isolation required on return, tens of thousands flocked to the coasts of Devon and Cornwall and the beautiful Lake District.

A year on, similar restrictions are still in place – you might have read last month’s rundown of 10 of the best UK staycation destinations to visit this summer – and UK holidays are once again the order of the day.

With demand soaring, maybe you are contemplating joining the holiday let market? A holiday home can be a useful source of income, supplementing your salary or your pension. But what happens when restrictions lift?

Will your holiday let become a financial burden or are staycations here to stay?

Keep reading to find out.

The state of the housing market: a quick recap

Back in March 2020, the property market was all but frozen as the government recommended that homebuyers delay transactions and postpone viewings.

After a challenging four months for the industry, the combination of lifting restrictions, the chancellor’s Stamp Duty holiday, and months of pent-up lockdown demand, led to a “mini-boom”.

At the time, the Guardian reported that the average price for a property coming onto the market reached more than £320,000 in July. The figures came from Rightmove and marked the highest price recorded since the site started reporting in 2001.

The boom didn’t end there though, continuing into December, and then through to the new year. The Office for National Statistics confirms that average house prices in Britain increased by 8.9% over the year to April 2021.

While forecasts made during the last year-and-a-half have highlighted the difficulty of making accurate predictions during a pandemic, the number of house sales is expected to rise in the second half of 2021.

Property website Zoopla confirms that the total value of homes sold in the UK could reach £461 billion by the end of the year. This marks an increase of 46% compared to 2020.

What does the state of the housing market mean for holiday lets?

This is Money recently confirmed that new owner enquiries to Sykes Holiday Cottages were up 80% when restrictions lifted last year. 2021 is expected to bring a similar increase.

With many holiday homes already fully booked, opening a new one could be massively profitable. Sykes confirm that the average four-bed holiday cottage generates a gross income of £21,000 per year. But there are many factors to consider before taking the plunge, including tax implications and the demands on your time.

A holiday let differs from a standard buy-to-let in many ways. There are some key questions you’ll need to ask yourself:

- Can you afford to be without any rental income during the off-season?

- Will you manage the property yourself (costing you time) or use an agency (costing you as much as 10% of your income)?

- Do you have money set aside for marketing?

You’ll also need to consider how easy it will be for you to secure a mortgage on a holiday let. Interest rates are usually much higher than a regular home loan – the average fixed rate was 3.93% in May 2021 – and you might need to prove you have the funds to cover the risk of dry spells or cancellations.

Finally, there are tax implications to consider. Buying a holiday let – as opposed to becoming a standard buy-to-let landlord – has tax advantages.

Holiday lets are treated more like businesses so many expenses, such as the cost of furniture, marketing, cleaning, and welcome packs, can all be deducted from pre-tax profits. You might also find that your property is exempt from council tax.

Will there be a second staycation summer?

The RAC are confident that staycations are here to stay, for this year at least. Its recent survey confirmed that 43% of drivers plan to stay in the UK and have dubbed the next few months “the second staycation summer”.

Holidaycottages.co.uk suggest the figure could be as high as 84%. They’ve also handily compiled a list of favourite destinations, perfect for helping you decide where your holiday let might be.

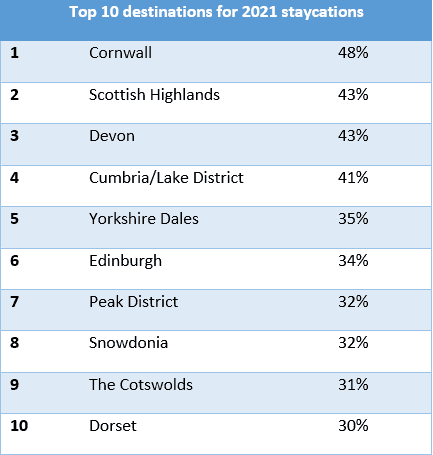

According to the research, the top 10 destinations on Brits’ staycation bucket lists are:

How the pandemic could alter holidaying trends long term

While some restrictions are lifting, those on foreign travel largely remain, ensuring the popularity of the staycation for this year. But might the pandemic have shifted perspectives long term?

The “think local” mentality of lockdown saw more of us supporting local businesses and increased recycling and reusing. We became increasingly conscious of our impact on the environment too.

When borders reopen, sustainable tourism – that eschews short-haul flights in favour of longer adventure holidays and greater immersion in local cultures – is likely to become more popular.

The reduced carbon footprint, not to mention the beautiful destinations the UK has to offer, means that the staycation is likely to retain its popularity too.

Get in touch for independent advice

If you are thinking about getting into the holiday-let market, be sure to speak to the experts. At Fingerprint Financial Planning, our team of independent mortgage advisors can help you find the best deal from across the whole of the market.

If you would like to discuss investing in buy-to-let or any other aspect of your financial situation, get in touch by emailing hello@fingerprintfp.co.uk or call 03452 100 100.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it. Buy-to-let (pure) and commercial mortgages are not regulated by the FCA. Think carefully before securing other debts against your home.