As the end of the year looms, now is a great time to take stock of the last 12 months and look forward to 2024.

2023 has been a year of stealth tax rises and continued allowance freezes but – thanks in part to the Bank of England’s (BoE) series of base rate rises – inflation has fallen.

Despite that, recent forecasts from the Office for Budget Responsibility (OBR) suggest a tough year ahead.

Keep reading for three important lessons from 2023, and three top tips for a financially successful 2024.

3 key lessons from 2023

1. Cash: High inflation can erode the value of cash savings

While inflation’s most recent peak occurred in October 2022 (a 41-year record of 11.1%) it remained high throughout 2023.

A key financial planning lesson is to hold an emergency in an easy access cash account, but this year has also highlighted the need to check in with cash savings regularly.

When cash savings rates are lower than the rate of inflation, your money is effectively losing value in real terms.

This makes it crucial that you hold only enough in your rainy day fund to tide you over should an unexpected financial shock occur. Aim to have the equivalent of three to six months’ household expenditure set aside.

As you might have read in November, it’s important to understand the value of long-term investments, even as inflation falls. In our article ‘Why now might still be the right time to invest despite rising rates’, we looked at the benefits of investing over holding too much money in cash – a great lesson to take into 2024.

2. Investments: Stock market volatility is to be expected

The last few years have been turbulent for stock markets. Uncertainty during the coronavirus pandemic was exacerbated in the UK by our slow economic recovery, the cost of living crisis, and the mini-Budget of September 2022.

Globally, Russia’s invasion of Ukraine and the Israel-Hamas war have added to the volatility during 2023.

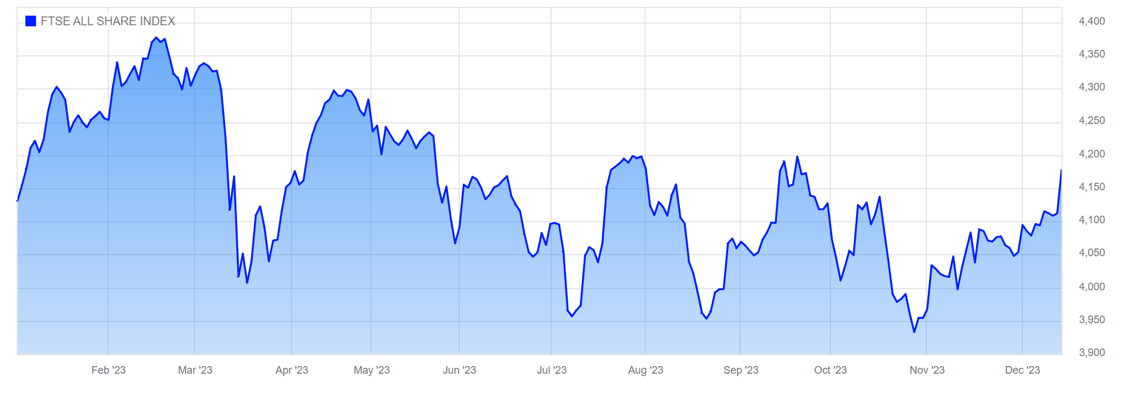

Here’s a look at the FTSE All-Share Index for the year to 14 December.

Source: London Stock Exchange

Periods of short-term market volatility are to be expected. That’s why we only recommend investing for the long term, and with a specific goal in mind.

Once your money is invested, keep it there by staying patient, ignoring the noise of global events, and remembering that the general trend of markets is upward.

Let’s take another look at the FTSE All-Share Index over the last 40 years.

Source: London Stock Exchange

Taking a longer-term view makes the upward trend clear. Take this lesson into 2024 and you’ll ensure your money is best placed to take advantage of market rises whenever they occur.

3. Your future self: Stay engaged with your pension into retirement

High inflation and volatile markets affect your pension as well as your other investments, and this remains true even once you retire.

Managing pension decumulation – when you begin to withdraw funds and take an income – is critically important.

Rising living costs can diminish the spending power of your pot while market dips mean you need to sell more units to receive the same level of income.

Rising life expectancies also mean your retirement income might need to last for longer, maybe even three or four decades.

At Fingerprint, we pride ourselves on providing advice from cradle to the grave so if you need help managing your pension withdrawals in 2024, be sure to get in touch.

3 top tips for 2024

1. Beware stealth taxes, or “fiscal drag”

Frozen allowances and falling thresholds are set to cost UK taxpayers in 2024.

Jeremy Hunt made no mention of the Personal Allowance in his Autumn Statement so it remains frozen until 2028.

The Office for Budget Responsibility (OBR) expect this freeze will result in:

- 4 million extra people paying basic rate Income Tax

- 3 million taxpayers moving to the higher rate

- 400,000 Brits paying the additional rate.

Inheritance Tax (IHT) thresholds also remain frozen and could affect you as the value of your estate rises. Read ‘3 simple steps to managing your Inheritance Tax liability as receipts soar’ if you missed our article in June.

2. Make the most of recent pension changes

The decision to abolish the Lifetime Allowance (LTA), while increasing the Annual Allowance meant that 2024 should be the year you fully engage with your pension if you haven’t already.

The LTA is the total amount of pension benefits you can withdraw in your lifetime without becoming liable for an additional charge. This will be scrapped from April 2024, removing the cap on pension savings.

You’ll still want your contributions to be tax-efficient though. You receive tax relief on contributions up to the Annual Allowance (£60,000 for the 2023/24 tax year) so make full use of this if you can afford to.

3. Factor in a potential rise in your mortgage repayments

The OBR also forecasts that interest rates could stay higher for longer, spelling bad news for borrowers.

In October, Sky News reported that around 5 million UK households will see their annual mortgage payments increase by an average of more than £5,000 by the end of 2024.

Whether you have already seen your payments rise, or you expect them to increase when your current deal ends, factoring this into your plans now will give you the best chance of managing the increase when it arrives.

If you’re worried about a potential mortgage rise, get in touch with us now.

Get in touch

If you would like help with any aspect of your finances now or into 2024 and beyond, speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

The value of investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.