Rising interest rates and falling inflation have made cash savings more attractive of late. You might even have been tempted to ditch your investments in favour of holding funds with your high street bank. But this could be a mistake.

Investments are a great, long-term way to see real growth and provide for your future. And while they do come with added risk, sometimes the biggest risk is not taking enough risk.

Keep reading to find out why now might be the perfect time to add to your investment portfolio or start investing for the first time. And why you should think twice before moving your investments into cash.

Savings versus investment in the current climate

The Office for National Statistics (ONS) recently confirmed that the Consumer Prices Index (CPI) rose by 4.6% in the 12 months to October 2023. This marked a significant drop from 6.7% in September.

After a sustained period of high inflation, this is good news. Especially as Times Money Mentor confirms that the best easy access savings rate (as of 22 November 2023) is currently 5.22%.

Remember, though, that a drop in inflation doesn’t mean prices are coming down – just that they are rising less quickly.

While cash remains the perfect place for your emergency fund, allowing you quick and easy access to your money when you need it, don’t neglect your investments.

3 reasons why now might be the perfect time to invest despite falling inflation and rising cash rates

1. Investment offers the chance of favourable returns and compound growth

At Fingerprint Financial Planning, we have decades of combined experience dealing with the stock markets. This means your money is in safe hands.

Markets generally trend upwards, despite periods of short-term volatility. Here’s the FTSE 100 over the last 40 years:

Source: London Stock Exchange

Despite significant dips representing (among other things) the Iraq War in 2003, the 2008 global financial crisis, and the start of the coronavirus pandemic in 2020, the general rise is clear.

The best way to take advantage of this upward trend is to stay patient and remain invested. This way, you’ll see good investment returns when times are good, and be best placed to reap the rewards of your patience when markets recover and prices rise. Trying to time the markets by moving money into cash during volatile periods could mean that you ultimately end up buying back shares at a higher price.

Keeping your money invested also means you’ll have a larger fund benefiting from the effects of compound growth. Effectively interest on interest, compounding can make a huge difference throughout your investment term.

2. Your investment is risk-managed, diversified, and aligned to your goals

The long-term financial plan you have in place is aligned with your goals. Your investment portfolio will play a huge role in attaining these.

Understanding your timescales, risk profile, and how the two interact is key. A longer-term investment, for example, might allow you to take a higher level of risk. You might also find that your risk profile isn’t static, but instead alters as you get older or your personal circumstances change.

Your high street bank rate will broadly reflect changes to the Bank of England (BoE) base rate. Up to the £85,000 Financial Services Compensation Scheme (FSCS) limit, your money is safe. Compared to this level of security, the additional risk associated with investing can seem daunting.

But your portfolio is diversified to spread risk. Your money will be invested across asset classes, sectors, and geographical regions. This means that a fall in one area will hopefully be counteracted by a rise in another.

It’s also why a 5% drop in the FTSE All-Share Index, for example, won’t automatically mean a 5% drop in the value of your invested fund.

3. You might find there’s tax to pay on interest and on any funds you divest into cash

Wrappers like your pension and Stocks and Shares ISA are incredibly tax-efficient. You receive tax relief on the pension contributions you make, while gains from your Stocks and Shares ISA are free of both Income Tax and Capital Gains Tax (CGT).

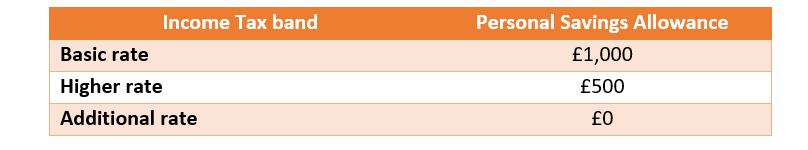

The interest you earn on non-ISA cash holdings, though, could become liable for Income Tax if you exceed your Personal Savings Allowance.

Source: HMRC

While rising saving rates are good news, they could mean you need to think carefully about the interest you earn.

You might also need to think about the tax implications of divesting into cash from your non-ISA portfolio. This is because the gains you make on the disposal could be liable for Capital Gains Tax (CGT) if they exceed the Annual Exempt Amount.

This is especially important currently because the exemption has been slashed in recent years, from £12,300 for 2022/23 to just £6,000. It drops again, to £3,000, from April 2024.

If you would like to manage your investment portfolio, or you’re looking

Get in touch

If you would like to manage your investment portfolio, or you’re looking to invest for the first time, we can help so speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

The value of investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.