Since their launch in 1999, Individual Savings Accounts (commonly known by their acronym “ISAs”) have become one of the most popular ways for UK savers and investors to store their wealth.

In fact, according to the Financial Times (FT), over 22 million people have an ISA. Of those individuals:

- 9 million hold a Cash ISA

- 9 million hold a Stocks and Shares ISA

- 4 million hold both of these.

ISAs are so favoured as they come with significant tax-efficient advantages. Any wealth you contribute to ISAs you hold is entirely free from Income Tax, Capital Gains Tax (CGT), and Dividend Tax.

Furthermore, there are different kinds of ISAs that you can use to achieve certain goals. You can open and pay into different kinds of ISA in a single tax year, mixing and matching across them to best suit your needs, too.

Yet, despite the immense popularity of ISAs, there is still considerable confusion about how they work. Data from a survey of UK adults published by Skipton Building Society reveals that:

- 70% are unsure how different types of ISAs work

- Almost half feel they need large sums of money to open an ISA

- 22% don’t want their money tied up into an account.

Furthermore, according to Money Marketing, only 26% of savers can correctly identify the ISA allowance. This is the maximum you can contribute to your ISAs in a single tax year, standing at £20,000 in the 2024/25 tax year. You can use this entire allowance on a single ISA, or split it across multiple accounts as you see fit.

These misconceptions could be holding you back from using ISAs to achieve your goals. So, in this ISA guide, read about how three key types of ISAs work, their various features and benefits, and why you may want to consider saving or investing in them to progress towards your financial targets.

Cash ISAs allow you to shield your wealth from Income Tax

As the FT figures quoted above demonstrate, Cash ISAs are the most used type of these accounts.

Cash ISAs behave much like a normal savings account. You contribute your money into your account where it will be held in cash savings, away from the stock market. You then receive interest at an agreed rate from your ISA provider.

You can open easy access Cash ISAs, giving you access to your savings as and when you want them. Alternatively, you could opt for a notice account, in which you must wait for a period (usually, 30, 90, or 120 days) to make withdrawals, usually in return for a higher interest rate.

Similarly, there are fixed-rate accounts that usually pay a greater rate of interest for a fixed term, in return for you locking away your money for that period – often between one and five years.

The key benefit of a Cash ISA is that wealth contained within one is entirely free from Income Tax. So, there will be no tax to pay on savings interest. This could be a concern currently as interest rates have been higher than before, and this could lead to a tax bill.

Moneyfacts data shows that the highest-paying easy access savings account offers a rate of 4.91% as of 26 July.

As higher-rate taxpayers can earn £500 in interest before tax is due thanks to the Personal Savings Allowance, that means you would only need around £10,500 in your account before you had to start paying Income Tax on your interest. Additional-rate taxpayers must pay Income Tax on all savings interest.

Meanwhile, there is no tax to pay on savings interest in an ISA, potentially making it an attractive place to hold your wealth.

This tax efficiency extends to the future, too, as withdrawals from a Cash ISA are also exempt from Income Tax. As a result, they can provide a tax-efficient way to construct part of your retirement income.

You can invest your wealth tax-efficiently in a Stocks and Shares ISA

Through a Stocks and Shares ISA, you can invest your wealth in a range of assets, including:

- Stocks

- Funds

- Investment trusts

- Corporate and government bonds

- Open-ended Investment Companies (OEICs)

Crucially, any returns your investments generate – whether that’s interest, gains, or dividends – are entirely free from Income Tax, CGT, and Dividend Tax.

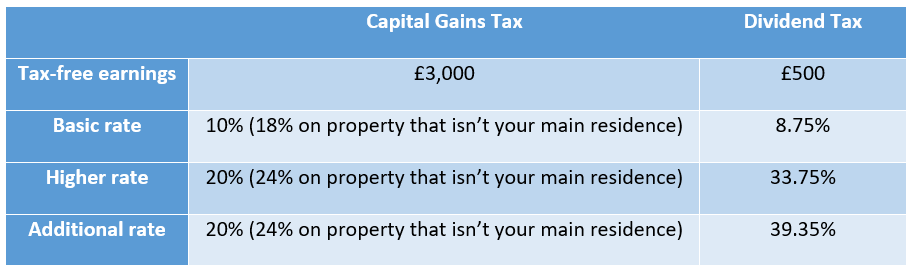

This can be a hugely powerful way to keep your investment portfolio tax-efficient, as CGT and Dividend Tax can eat into the value of your returns. The table below shows how much you can generate in gains and dividends before tax is due, and what you will typically have to pay on non-ISA investments in 2024/25, depending on your marginal rate of Income Tax:

As you can see, these taxes could be costly, especially when liquidating investments to fund your lifestyle.

So, using a Stocks and Shares ISA to hold a portion of your portfolio can be an effective way to grow your wealth, ensuring you are the biggest beneficiary of the returns you could generate.

Lifetime ISAs are specifically for saving toward a first home deposit, or retirement

A Lifetime ISA (LISA) is a type of account exclusively for those aged 18-40 who are looking to save toward the deposit for a first home, or retirement. You must make your first contribution to a LISA before your 40th birthday, and you can continue contributing up to age 50.

You can contribute up to £4,000 a year to a LISA in 2024/25, and this counts towards your overall ISA allowance (£20,000 in 2024/25).

Importantly, the government will pay a 25% bonus on your contribution, meaning you can receive up to an additional £1,000 a year if you contribute the full £4,000.

Once you are going through the process of buying a first home, your solicitor will instruct your LISA provider to release the funds directly to them to use as part of the purchase.

You can save through a Cash LISA or invest through a Stocks and Shares LISA. Theoretically, you can open both types of account, but remember that you are restricted to the total £4,000 annual subscription limit across the two, and you can only use one account per person during a first property purchase.

As with other kinds of ISAs, any interest, returns, or dividends generated in your LISA are free from Income Tax, CGT, and Dividend Tax.

Bear in mind that you must use the savings to buy a first home. Otherwise, you cannot access your wealth until age 60 without facing a 25% withdrawal charge. This steep penalty will recoup the entire government bonus, as well as some of the interest or returns your wealth has generated. Furthermore, you can only use a LISA to buy a home with a value of £450,000 or less.

So, think carefully before contributing to a LISA.

Get in touch

Want to find out how you can use ISAs to help you progress toward your long-term goals? Speak to us today. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.