A recent Which? report confirmed that the government’s Stamp Duty holiday has cut more than £4,000 from the average cost of moving home. But, with other expenses on the rise, average UK moving costs are around £7,000.

Moving to a new house can be expensive then, but it can also be very stressful.

2020 so far has not been an average year. The property market freeze, and subsequent reopening following the relaxation of lockdown restrictions in May, led to a mini market boom. The Stamp Duty holiday has also had an impact.

If you’re looking to move to a new house in the next few months, how will the costs add up? And what might your motivation be for moving in the first place?

Your reasons for wanting to move will be individual to you

Your decision to move to a new house could be motivated by many different factors. Your time of life, your financial stability, and your desired lifestyle – both for you and your family – could signal that it’s time to make a move. Some of the most important factors might be:

- School catchment area

Research from Santander Mortgages recently found that more than a quarter of parents are willing to pay a ‘school catchment premium’ – on average, around £20,000 – to live within the catchment area of a good school.

Despite this, figures from the Department for Education confirm that almost one in five children did not receive their first choice of secondary school last year.

Parents in the Santander study rated the school catchment area as more important than transport links, and family and friends in determining the location of a house move.

- More (or less space)

If you have a growing family, you might find that you need extra space and are looking for an upgrade. Later in life, and with the children having flown the nest, you might be looking to downsize.

You might even be hoping to free up some of the proceeds to spend in retirement.

- A change in lifestyle

The coronavirus pandemic has given us all reason to reflect. You might have been working from home and now you’re looking for a property with a home office? Maybe lockdown in the city was cramped and you’re eyeing a move to the country and a house with a garden?

Goals, aspirations, and outlooks can all change as we get older. A move to a new house could reflect and complement that change.

How the cost of an average house move is broken down

1. Stamp Duty

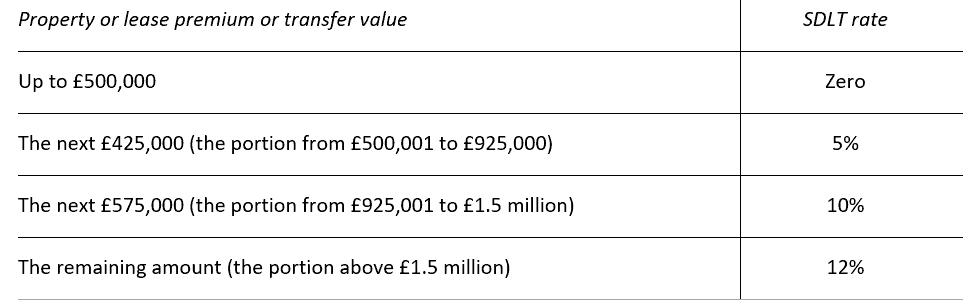

Stamp Duty Land Tax (SDLT) is a tax based on the value of a property. It applies in England and Northern Ireland.

Normally, the threshold for residential properties is £125,000, meaning you won’t pay Stamp Duty if the value of the house you’re buying is below that amount.

Earlier in the year, chancellor Rishi Sunak announced a Stamp Duty holiday. If you purchase a residential property between 8 July 2020 and 31 March 2021, you only start to pay SDLT on any amount above £500,000.

This is the case regardless of whether you are a first-time buyer, a current homeowner, or you have owned a home before.

This table shows the SDLT payable – on a sliding scale – for each price threshold:

2. Property surveys

When you’re buying a house, it’s a good idea to get a survey completed. The initial outlay is high, but a survey could highlight an issue. The cost of the survey may well be less than the cost of fixing an expensive problem once the sale is complete and you own the house.

Surveys range from a ‘level one’ condition report to a ‘level three’ building survey. A basic condition report might cost around £300 to £400, while the more comprehensive building survey could be around £2,000.

3. Legal fees

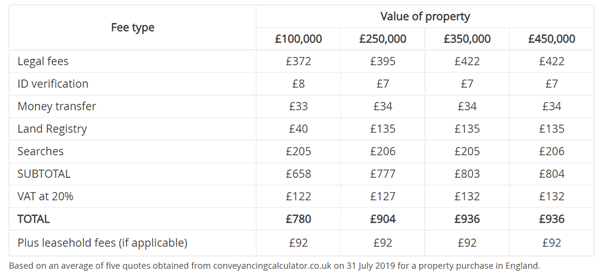

You’ll likely need a property solicitor or conveyancer to prepare legal documents, deal with the Land Registry, and transfer payment. A solicitor will also ensure the transfer of ownership has been completed legally.

Source: Which?

The cost of legal fees is partly determined by the value of the house, but you should expect to pay between £800 and £1,000.

Get in touch

Stamp Duty, surveys, and legal fees represent three of the biggest single expenditures, but the costs associated with moving don’t end there.

You’ll also need to think about arranging a new mortgage, the cost of removals on the day, and finding new deals from water and energy suppliers.

If you’re thinking of moving to a new house and would like to discuss where the move fits into your current financial plans, get in touch. Please email hello@fingerprintfp.co.uk or call 03452 100 100.