When the BBC revealed the size of its gender pay gap in 2017, it brought to public attention a longstanding and much wider issue.

The release of salary information was part of a government initiative that forced all companies with over 250 employees to report gender equality data annually. The deadline in 2020 was extended due to the coronavirus pandemic.

While companies, including the BBC, have looked to redress the pay balance, the long-term effects on women’s savings, investments, and pensions are huge.

And while coronavirus has given companies a six-month reprieve in reporting, some groups of women – ethnic minorities, the self-employed, mothers – have been more vulnerable to the economic impact of the pandemic than others.

While financial planning can’t remove the barriers created by wage inequality, at Fingerprint Financial Planning we can take a holistic view of your finances and help you put together a long-term plan that puts you in control.

Keep reading to find out how.

Women are saving more than ever

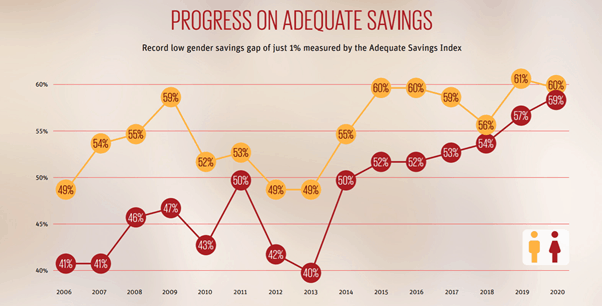

A recent “Women and Retirement” report from Scottish Widows found that the gap in “adequate saving” between men and women is just 1%. Adequate saving here is categorised as 12% of income or being part of a defined benefit (DB) scheme.

Source: Scottish Widows

While a 1% gap is encouraging – it equates to 59% of women aged over 30 saving adequately – pay gaps mean there is still a marked difference in the final amounts involved.

The effects of the gender pay gap on retirement savings

The same Scottish Widows report found that a woman on the median wage throughout a 44-year career, making the average rate of pension contributions, would retire with a pension pot worth £100,000 less than a male colleague.

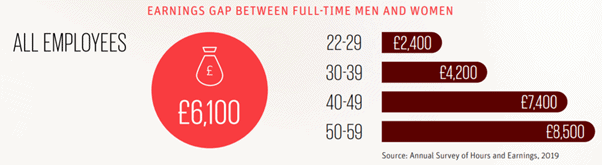

The report blames “structural inequalities”, pointing to the higher proportion of female part-time workers and salary differences for those in full-time employment.

Source: Scottish Widows

The average annual difference in median wage between men and women in all jobs is £10,800.

When pension contributions are calculated as a percentage of pay, it becomes clear how a sizeable disparity in the size of final retirement pots could occur.

Fingerprint Financial Planning can help

While the gender pay gap means that women will face greater barriers when saving for retirement, expert advice and independent financial planning can still help to make a significant difference in retirement.

Yet, recent figures from the FCA’s “Financial Lives” survey, find that women are less than half as likely as men to be highly engaged with their pension. Just 12% of women are highly engaged compared to 26% of men.

If you are struggling to remain engaged in your pension planning, speak to Fingerprint Financial Planning now.

Planning for the long-term

The most important thing you can do when trying to provide a stable financial future is to start saving early. Paying your future self first is a budgeting technique that means putting aside savings, investments, and pension contributions before budgeting with what remains.

Speak to us and we can use cashflow modelling and in-depth fact finds to understand what your dream retirement would look like, then work out how much you need to put aside to get you there.

Starting as early as possible means a greater number of overall contributions, while benefiting from the effects of compound growth to further inflate the size of your pot.

Your workplace pension

Auto-enrolment has made a huge difference in the number of workers saving for retirement.

In the first six years after its introduction, the proportion of eligible staff saving into a workplace pension expanded rapidly. It rose from 55% to 87%, according to The Pensions Regulator, but the minimum contribution amount is unlikely to be enough to provide you with your desired lifestyle in retirement.

Factoring in the State Pension might help but could still leave you with a shortfall.

Not only do you benefit from tax relief when you contribute to your workplace pension, but for every contribution you make, your employer contributes too.

For the 2021/22 tax year, the minimum contribution is 8%. Your employer must contribute a minimum of 3%, which leaves you to pay the remaining 5%, but remember that you can pay more. Some employers may even up their contribution if you increase yours.

Financial planning puts you in control

At Fingerprint Financial Planning we take a holistic review of your finances. Although we might advise you on specific products to meet short-term goals, our main focus will be your long-term financial security.

That means long-term planning, with regular reviews that keep you engaged and on track, while increasing your confidence in your financial future.

Get in touch

At Fingerprint Financial Planning we understand that gender inequality will make retirement planning – and gaining overall financial security – harder as a woman. We can help you put long-term financial plans in place that provide protection and a route to your long-term goals.

If you want help making your dream retirement a reality, speak to us. Get in touch by emailing hello@fingerprintfp.co.uk or call 03452 100 100.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of, and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.