On 15 February 2024, the Office for National Statistics (ONS) confirmed that Gross Domestic Product (GDP) fell 0.3% in the final quarter of 2023. This followed a 0.1% drop in the third quarter and meant that the UK had tipped into a technical recession.

The news made uncomfortable reading for prime minister Rishi Sunak and his government, who pledged to grow the economy. More recently, there has been positive news. The latest ONS estimates suggest that real GDP grew by 0.2% in January 2024, meaning we could soon be out of the recession.

But what is the effect of a recession on your financial plans and should you be doing anything differently?

Keep reading to find out.

A technical recession is defined as 2 consecutive quarters of negative economic growth

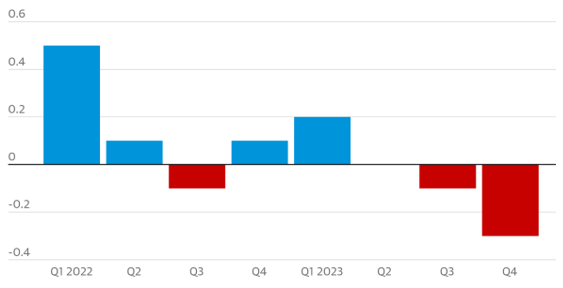

Following the 0.1% drop in growth for quarter three of 2023, the Bank of England (BoE) had forecast 0.0% growth for quarter four of 2023. This would have meant the UK avoided a recession, which only occurs when economic growth is negative for two consecutive quarters.

UK economic growth since quarter 1 2022 (%):

Source: The Guardian

The surprise drop of 0.3% came as millions continue to feel the squeeze of high borrowing costs and rising household bills. Ongoing strikes added to workers’ woes and led to lower spending in the run-up to Christmas, with heavy rainfall also cited as a reason shoppers kept away from high streets.

A technical recession represents a headache not only for the government but the BoE too.

The central bank is already juggling rising interest rates against the need to stay on top of rising prices. While the BoE’s mandate is to target inflation, rather than support economic growth, the bank won’t want to see the recession deepen.

On this note, though, there is promising news. The latest ONS estimates suggest that real GDP grew by 0.2% in January 2024. We could, in that case, be said to be out of the technical recession already.

A technical recession is a short-term blip, not a cause for long-term concern

As you will have heard us say before, markets hate uncertainty. A surprise drop into recession will make investors nervous but that doesn’t necessarily mean you need to be concerned about your long-term investments.

Your financial plans take a long-term view exactly to ride out periods of short-term volatility. The portfolio you have built is also diversified across asset classes, industries and sectors, and geographical regions.

This means that a drop in one area will hopefully be counteracted by a rise in another. As with any other short-term dip, the most important thing you can do is not panic.

Remember to stay focused on your long-term goals and ignore the noise of outside events. Global unrest and political upheaval at home and abroad will affect stock markets over the next 12 months but remaining unemotional and avoiding knee-jerk reactions is key.

If you’d like advice on how to manage your investments or you’d like reassurance during tough times, get in touch now.

The outlook for the rest of 2024 is mixed but there are reasons to be positive

While the UK slipped into recession at the end of 2023, overall growth for that year stood at 0.1%. While this isn’t headline-grabbing, positive growth is only ever a good thing and 2024 could see more of the same.

Reuters recently confirmed that back in February, the BoE projected growth of around 0.25% in 2024. The Office for Budget Responsibility (OBR), though, forecast an economic expansion of around 0.8%.

It’s worth noting here, as the BBC reported back in January 2023, that the International Monetary Fund (IMF) expected the UK economy to shrink by 0.6% in 2023. The economy could well exceed expectations again.

And there are some reasons to be optimistic.

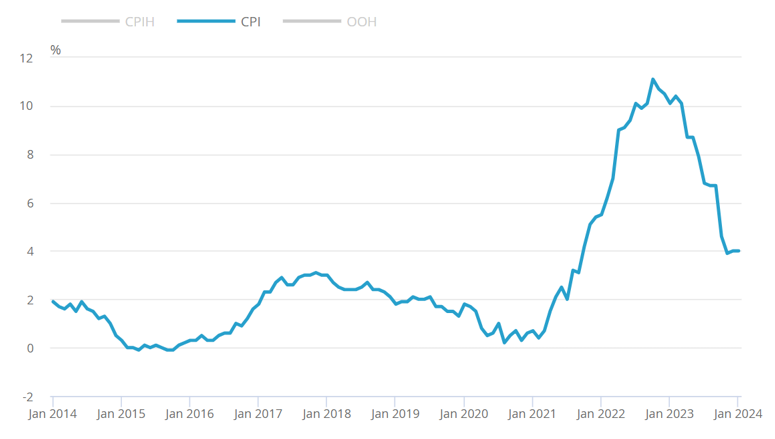

Back in March 2023, the Consumer Prices Index (CPI) stood at 10.1%. Since then, it has fallen significantly.

Consumer Prices Index (CPI) since January 2014:

Source: ONS

Despite a short-term technical recession, interest rate rises too may have peaked.

Commentators are widely expecting the next movement of interest rates to be a downward one. The BoE’s Monetary Policy Committee (MPC) will meet next on 21 March.

Finally, while 2023 saw the continued conflict in Ukraine, the Hamas-Israel War, and political upheaval in the UK, markets generally rallied. This bodes well for what promises to be a turbulent political year, with 70 countries heading to the polls, including a UK general election and the US presidential election.

Get in touch

If you have any questions about your financial plans for 2024, be sure to speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.