With the UK cost of living crisis lingering and short-term market volatility a constant threat, you might be wondering if now is a good time to invest. This is a fair question whether you’re a first time investor or looking to add to an existing portfolio.

Interestingly, one area that might provide an answer, and a note of much-needed optimism, is the US markets.

Investment carries risk and there are no guarantees. You’ll have heard us repeat often that past performance is no guarantee of future success. We’ll also have advised you against chasing trends or making snap emotional decisions.

A recent report, though, has looked at the possible correlation between US politics and developed markets.

Keep reading to find out what Joe Biden’s third year as president could mean for you and your investments.

Forecasts for the US market could be good news for your investments

A recent report in the Telegraph looked at the so-called “sweet spot” of US politics and its stock prices.

It concludes that America’s reliable four-year presidential cycle has historically seen third year stock price rises.

Election years are rife with uncertainty. So, too, are the first two years of a new presidency, when the bulk of legislative changes occur. And as we know, stock markets hate uncertainty.

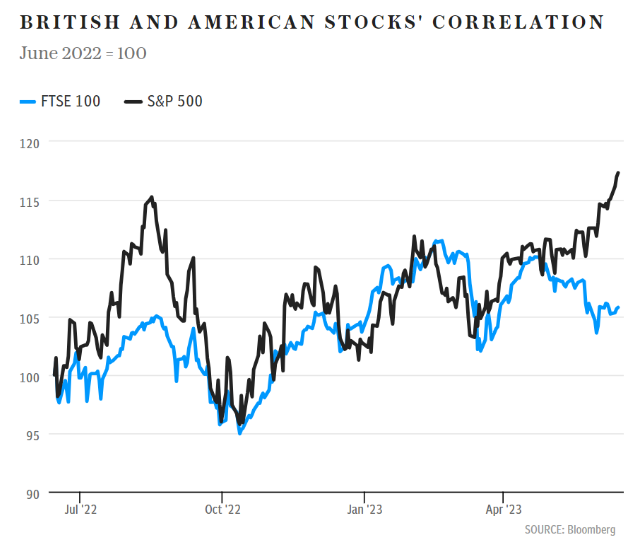

Year three, however, is generally calmer. This period of comparable tranquillity, so the article argues, is reflected in US markets and, by extension, in UK markets too.

Here we can see how two developed markets – the FTSE 100 and the S&P 500 – have moved in relation to each other over the last 12 months:

Source: The Telegraph (Bloomberg)

A long-term look at both markets finds that the:

- S&P 500 hasn’t posted a negative result in the third year of a presidential term since 1939, the year the second world war started.

- FTSE All-Share Index has had just two negative third years since 1947.

Interestingly, Biden’s huge package of Covid relief, Trump’s Income Tax cuts, and “Obamacare” all arrived in the first two years.

The UK economic outlook is improving

Whether or not US politics is playing a part, recent news about the UK economy is largely positive.

The most recent inflation figures from the Office for National Statistics (ONS) confirm that the Consumer Prices Index (CPI) for June stood at 7.9%. This is down from 8.7% in the 12 months to May 2023, and a greater decrease than many were forecasting.

In turn, this spells good news for mortgage holders. The fall means that the Bank of England (BoE) might not have to increase its base rate quite as sharply as anticipated. The Monetary Policy Committee (MPC) is due to meet again on 3 August.

Slower than anticipated price rises doesn’t mean that prices are dropping, nor that the cost of living crisis has ended. But it does suggest an economy moving in the right direction.

Your best strategy is ignoring the noise and focusing on your long-term goals

There are three important factors to remember if you are worried about your investments.

1. Global events can affect markets but they won’t alter your long-term plans

You don’t have to look too far to see how global events can affect world markets.

Here’s the FTSE 100 since June 2019:

Source: London Stock Exchange (LSE)

The effect of the coronavirus pandemic is clear. So too is the fallout from the second Iraq war and the 2008 global financial crisis.

Your investment strategy, though, is based on your long-term aspirations. It is unlikely that any of the above events will have changed your dream retirement. For that reason, they shouldn’t change your later-life plans either.

2. The markets tend to rise over the long term, so stay patient

Regardless of what the US or UK markets are doing at any given time, your investment is long term and that means you can afford to look for long-ranging trends.

The general trend of the market is upward so that should be your focus.

Take an interest in global politics, but don’t let its background noise tempt you into impatience or emotion-led investment decisions.

3. A diversified portfolio takes advantage of rises across geographical regions and sectors

Your investment portfolio is diversified across asset classes, geographical regions, and sectors. This has the effect of spreading your exposure to risk.

It is hoped that a drop in one area will be offset by a rise in another.

A bullish US market is good news for investments held in that region and could affect UK markets. But your portfolio will be made up of investments in other regions and sectors, and in assets other than stocks and shares, so you’ll need to think about the wider picture too.

Get in touch

If you would like help deciding on the right investment strategy for you, or you’d just like some reassurance in uncertain times, speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

The value of investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.