Next week (2 to 8 October 2023) marks Good Money Week in the UK. Formerly Ethical Investment Week, the UK Sustainable Investment and Finance Association (UKSIF) has been coordinating and running the event since 2005.

Designed to get us all thinking about the benefits of sustainable and ethical investment, the UKSIF looks to engage with people from all walks of life and income levels through professional financial advisers, charities, and faith communities.

But you don’t need to wait for Good Money Week to roll around each year to think about how you might align your money with your values.

A huge area of political debate and ESG fund soul-searching is currently around clean energy versus fossil fuels. It’s an argument that also highlights some of the difficulties you might face as you look to “green” your investments.

Thankfully, our team of expert financial planners is on hand to help.

“What you do makes a difference, and you have to decide what kind of difference you want to make”

Jane Goodall, renowned primatologist, anthropologist, and founder of the Jane Goodall Institute once said, “You cannot get through a single day without having an impact on the world around you.”

So, if you’re going to make a difference regardless, why not try to make sure it’s a positive one?

While the Jane Goodall Institute is concerned with the loss of chimpanzee habitats due to, among other things, logging and bauxite mining, fossil fuel production is also resulting in enormous harm to the planet.

It’s a cause that’s been taken up by Swedish climate change activist Greta Thunberg. She recently had a well-publicised run-in with the investment company Baillie Gifford, accusing them of “greenwashing”. Thunberg withdrew from the Edinburgh International Book Festival in protest at the level of investment Baillie Gifford has in fossil fuels.

The company responded by saying that “Only 2% of clients’ money is invested in companies with some business related to fossil fuels.” The market average, meanwhile, is around 11%.

“I’d put my money on the sun and solar energy. What a source of power!”

These words are credited to Thomas Edison, back in 1931. He went on to say, “I hope we don’t have to wait until oil and coal run out before we tackle [solar energy].”

More than 90 years later, clean energy has the power to cut energy costs and lower carbon emissions but is progress too slow?

Our main sources of renewable and clean energy are:

- Solar

- Wind

- Biomass

- Geothermal

- Hydro

These have huge potential to generate clean, renewable, and efficient energy, but even ESG funds are currently heavily reliant on fossil fuel companies.

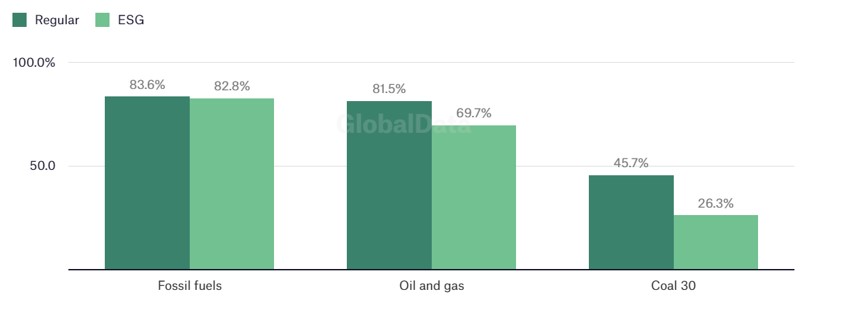

Here we can see the percentage of funds with at least some exposure to fossil fuels, oil and gas, and the 30 largest owners of coal-fired power plants in developed markets (plus India and China).

Source: Energy Monitor analysis of As You Sow/Morningstar Direct data. Note: The sample includes 2,684 equity mutual funds and ETFs domiciled in the US that are not sustainable v 320 classed as sustainable by Morningstar.

Changes are occurring though, if slowly. As Bailie Gifford said, in response to Greta Thunberg’s accusation of greenwashing, “When we invest in companies… we do so over long time periods – typically 10 years or more – so this has naturally led us away from traditional fossil fuel firms.”

As countries begin to move away from fossil fuels and look to their Paris Agreement targets, the clean industry will continue to grow.

The FCA is also working hard to tackle the issue of greenwashing, helping to give you greater confidence in the claims of “green” companies and the ESG funds your money is invested in.

“To… save our planet from the ravages of climate change, we need to ultimately make clean, renewable energy the profitable kind of energy”

Barack Obama understood the importance of clean energy during his time in power and some progress is being made.

A recent Goldman Sachs report on clean energy found that:

- The price of solar modules has dropped by 85% and indirectly led to more than seven gigawatts of solar being installed in the US in 2015, equivalent to taking 2.3 million cars off the road or planting 10 million acres of forest.

- Wind energy has grown by almost a quarter (24%) a year globally since 2000.

- 21% of Brazil’s industrial sector is now powered by biomass.

- 25% of Iceland’s electricity is currently powered by geothermal sources.

- 20% of global electricity capacity is provided by hydroelectric power.

All of this points to clean energy becoming increasingly mainstream, with the potential to transform our world and effect positive and timely change.

Get in touch

The world of ESG investment is constantly evolving but if you would like to align your money with your values on environmental, social, and governance issues, this Good Money Week might be the perfect time to do so.

At Fingerprint Financial Planning, we understand the importance of sustainability and the difference that “greening” all of our money can make. For help on anything you’ve read in this article, get in touch with our team of professional and expert financial planners by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

The value of investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.