On 3 August 2023, the Bank of England (BoE) raised its base rate for the 14th consecutive time.

From just 0.1% in December 2021, it has steadily risen and currently stands at 5.25%. This figure marks a 15-year high as the central bank’s Monetary Policy Committee (MPC) continues its struggle to bring UK inflation back under control.

But what do still-rising rates mean for your finances, from your savings and investments to your mortgage?

Keep reading to find out.

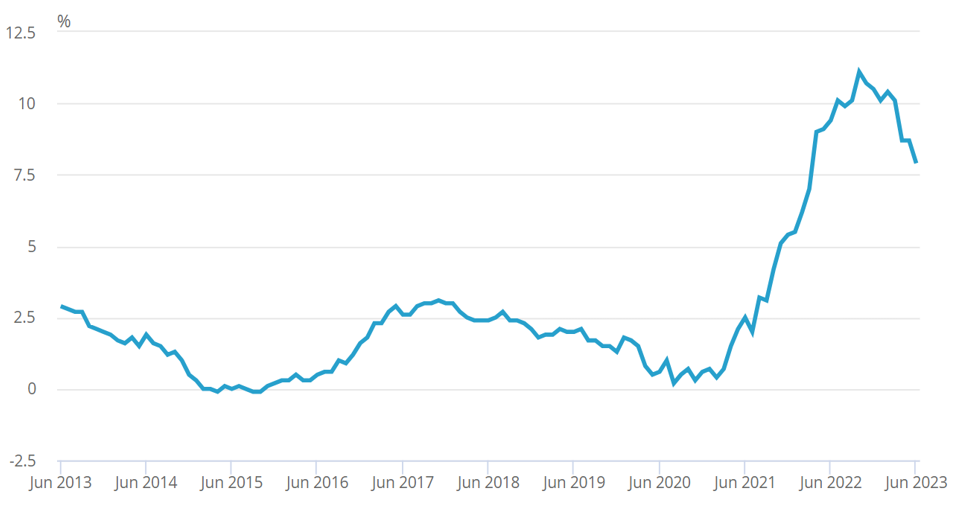

Inflation increased rapidly when Covid lockdowns ceased, though it’s beginning to fall

The MPC meet eight times a year to decide on the official UK interest rate – the BoE base rate. Its decisions are informed by the need to sustain growth and employment and to keep inflation at the BoE’s 2% target.

This latter aim has proved difficult over the last couple of years. Inflation began to rise sharply back in early 2021 and again that summer, when Covid restrictions were lifted.

UK consumers, after months of being locked down, had accrued “accidental” savings and were ready to spend. But labour shortages, global supply change issues, and the economic impact of political decisions in China all conspired to decrease supply at a time when demand was high.

Prices began to rocket and the UK Consumer Prices Index (CPI) rose accordingly.

CPI June 2013 to June 2023:

Source: Office for National Statistics (ONS)

Aside from two month-on-month drops, the CPI rose steadily from a February 2021 low of 0.4% to a 41-year high of 11.1% in October 2022.

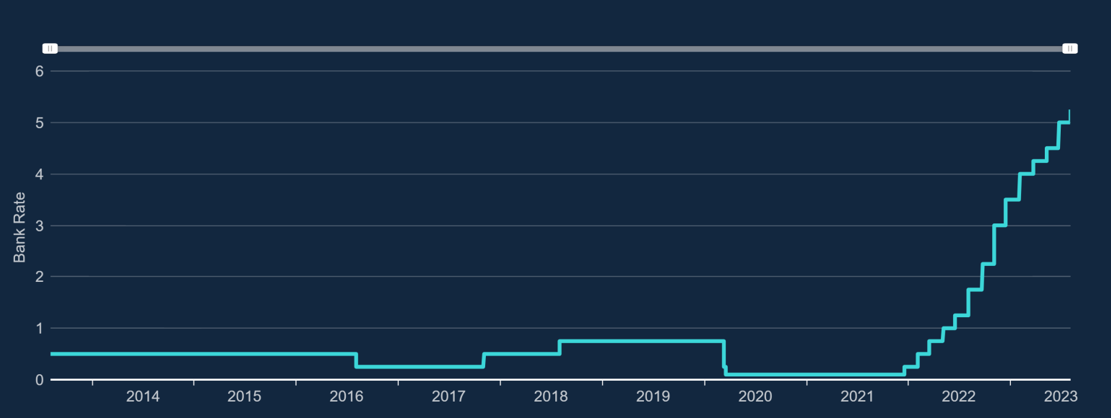

Base rate rises are a tool the BoE uses to keep inflation in check, but doing so is currently proving tricky

By increasing the base rate, the BoE makes borrowing more expensive, and so dissuades spending. If we’re spending less, demand drops and so do prices, decreasing inflation.

For this reason, the BoE has been increasing its base rate since December 2021. Back then it stood at just 0.1%. It currently stands at 5.25%.

BoE base rate since August 2013:

Source: BoE

The BoE expects inflation to return to its 2% target by early-2025 but it currently isn’t falling fast enough. This has forced the BoE’s hand and explains the rise to its current 15-year high.

But what does the increase mean for you?

A rising base rate can affect your savings, investments, and mortgage so advice is key

Savings and investments

After 18 months of base rate rises, we are starting to see these reflected in cash savings rates.

Back in November 2021, the average rate for an easy access savings account (according to The Times Money Mentor) was 0.19%. The best rate as of 3 August, meanwhile, was 4.63%.

This is good news for your savings but remember that the current CPI is higher than the current “best” rate. That means the cost of goods is rising faster than your savings are earning interest.

Pu another way, your money is effectively losing value in real terms.

Investing carries risk but comes with the potential of making inflation-beating returns. In the current climate, you might find that the biggest risk is not taking enough risk.

If you’d like to consider a new investment or you want to add to your current portfolio, get in touch and we can help to ensure you make the right choice for you.

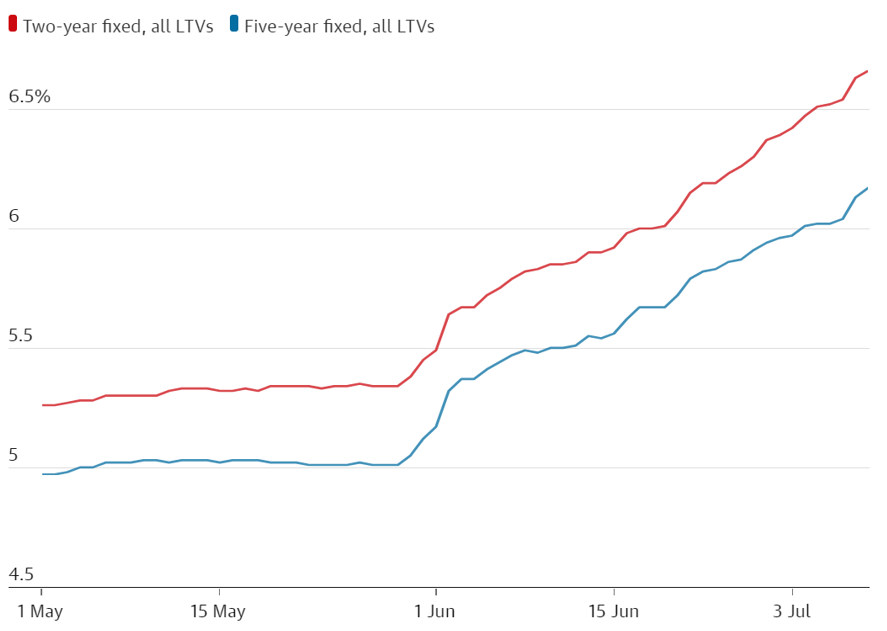

Your mortgage

A rising base rate increases the cost of borrowing so mortgage rates are rising. Figures from May 2023 show the most recent sharp rise. The average new two-year fixed rate as of 11 July was 6.66%.

Source: The Guardian (figures from Moneyfacts) – Note: LTV (loan to value) is the mortgage amount borrowed to the deposit paid.

If you are a first-time buyer or your current fixed-rate deal is coming to an end, you’ll need to be prepared for higher repayments while the BoE base rate continues to rise.

We can help you to budget for these changes so be sure to get in touch with our expert team of mortgage brokers.

The base rate will only fall when inflation cools

While it is impossible to say for certain when the base rate will begin to fall again, the link to inflation is clear. The BoE expects inflation to fall sharply in the second half of 2023 and if it does, the base rate will drop too – though expect a delay between the two.

In the meantime, though, this may not be the last rise we see. The Times Money Mentor recently confirmed that interest rates are forecast to peak between 5.75% and 6% by the start of 2024. After that, they could begin to fall. How quickly, though, will depend on inflation.

Get in touch

If you are worried about the impact a rising base rate has on your long-term financial plans, speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

The value of investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.