Trying to predict the future of the housing market is fraught with danger, especially following several years of growth and a tumultuous 2022.

Never an exact science, even the experts have been left flummoxed as they try to look ahead to the rest of 2023 and beyond, with leading mortgage lenders unable to agree.

While Nationwide recently announced the largest annual fall in house prices in over a decade, Halifax calculated a 2.1% rise in the annual rate of house price growth in its report.

With uncertainty rife, keep reading for your look at where the housing market stands now, and what we might see during the rest of the year.

Economic turmoil continues to spell trouble for buyers

The next few months are usually busy ones for the property market. Better weather and longer days make house viewings more appealing, while a spring start could see young families move into their new homes in time for the school summer holidays.

The UK’s current economic difficulties, though, mean that many would-be homebuyers remain mired in a worrying affordability crunch.

While inflation dropped for March, in line with Bank of England (BoE) predictions, the decrease wasn’t as pronounced as might have been expected. The Office for National Statistics (ONS) confirms that the Consumer Price Index (CPI) dropped from 10.4% in February to 10.1% in the 12 months to March 2023.

The relatively small drop has led to increased speculation that the BoE will raise its base rate again. This would mark the 12th consecutive rise since December 2021 and be further bad news for borrowers. The rate currently stands at 4.25%.

Mortgage rates, meanwhile, soared following Kwasi Kwarteng’s disastrous mini-Budget in late-September 2022 and high rates could mean first-time buyers struggle to get their foot on the ladder this year.

If you are looking to move house in the next few months, you’ll need to be aware of the effect of rising mortgage rates when your current deal comes up for renewal.

Uswitch recently confirmed that around 350,000 fixed-rate mortgages were renewed in the first quarter of 2023. Moneyfacts, meanwhile, suggests that borrowers who locked into a £200,000, 25-year mortgage at 2% would have been paying around £848 a month, before renewal.

Rising rates, though, mean that the same borrower renewing in Q1 2023 would have seen their payments rise by nearly £400 a month. This is based on the average five-year fixed rate for January 2023 standing at around 5.6%

House price changes are harder to predict

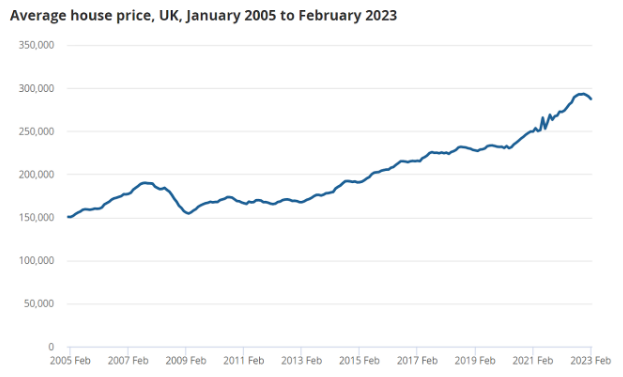

House prices have been on the rise for the last decade, while, more recently, falling mortgage rates have led to a mortgage “price war” between lenders. The cost of buying a house remains higher than before the pandemic.

That said, the latest ONS UK house price index for February 2023 confirms that the average price dropped for the third consecutive month in February. Following a £293,369 peak in November 2022, the figure for February stood at £287,506.

Source: ONS

The fall in prices may well be indicative of a wider trend that could see a gentle swing toward a buyer’s market as 2023 progresses.

It is worth noting, though, that as an average for the last 12 months, UK house prices increased by 5.5% to February 2023. This was a decrease of 1% from 6.5% in the 12 months to January 2023.

As well as falling house prices, the number of homes coming onto the market is increasing. This is partly due to spring being one of the housing market’s busiest periods and also rising optimism among consumers.

Which? recently reported that 75% of homes are currently selling below their original asking price, with the average reduction being around 6%. That equates to £22,000 for a home with a £365,357 asking price.

Halifax, meanwhile, has calculated an average asking price discount of £14,000.

Either way, the figures suggest that if you are looking to buy a home this spring, you’ll be in a good position to negotiate.

Get in touch

Differences in market forecasts highlight the volatility of the housing market currently but falling prices and an increasing number of properties entering the market spell good news for buyers.

Whether you’re looking to upgrade, downsize, or get onto the property ladder for the first time this spring, contact us now to see how our expert financial planners and mortgage advisers could help you. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.