At the end of summer 2022, UK house prices had largely recovered from the uncertainty of the pandemic years and reached record highs. Then came the mini-budget.

Since then, short-term turbulence has persisted, due in part to continued high inflation during much of 2023 and concerns about whether the Bank of England (BoE) would opt to reduce the base rate.

Now, with 2024 drawing to a close, the market is showing positive signs again. With the Autumn Budget bringing tax rises and changes to Stamp Duty from April 2025, volatility will be on the horizon once again, but optimism looks likely to prevail.

Keep reading for a closer look at what might happen in the property market in 2025. Plus, read your guide to imminent Stamp Duty changes and what they might mean for you.

Forecasting the property market isn’t easy and 2025 is no exception

Base rate drops signal increased optimism tempered by the Autumn Budget

While the BoE base rate (and so the cost of borrowing) remains high, house price growth is expected to be slow.

Thankfully, though, at its last meeting on 6 November, the BoE’s Monetary Policy Committee opted to lower the rate by 0.25%. In October, the BoE’s governor, Andrew Bailey, told the Guardian that he hoped base rate cuts could become more aggressive as inflation stabilises.

This should give buyers, sellers, and the overall market confidence that things are heading in the right direction.

The Autumn Budget, though, did cause some experts to downgrade their original 2025 forecasts. According to MoneyWeek, Knight Frank predicts average UK house price growth of:

- 5% for 2025

- 3% for 2026

- 3.5% in 2027.

These figures are downward estimates since August 2024, when the predictions were growth of 3%, 4% and 5% respectively.

Zoopla too expects an average increase of 2.5% over 2025.

A jump in property transactions is predicted for early 2025 before Stamp Duty changes arrive

The chancellor used her Autumn Budget to announce Stamp Duty changes that will come into effect from April 2025 (more on the specifics of this later).

The announcement is expected to force some first-time buyers to rush into completing a purchase before the changes arrive. In fact, Nationwide confirms that house prices jumped by 3.7% year-on-year in November, compared to 2.4% in October.

The BBC reports that 2025 could see an initial house-buying surge followed by a six-month slump.

Changes for April 2025 will affect the level at which Stamp Duty starts being paid

Stamp Duty is effectively the tax you may pay when you buy property or land, with the rate payable depending on the value of the purchase and whether it will be your main residence.

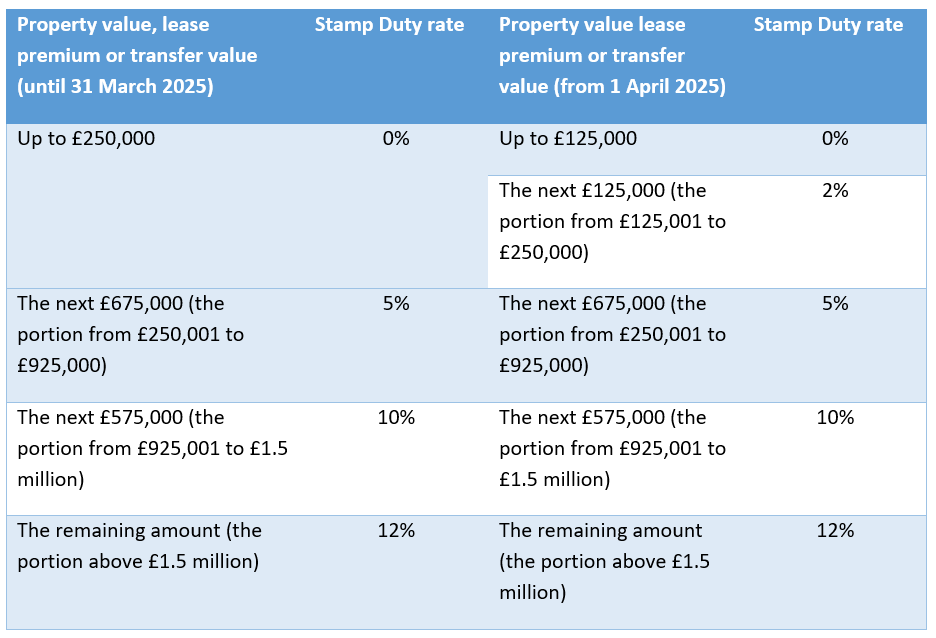

Liz Truss lowered Stamp Duty thresholds in 2022, but the temporary measure will end on 1 April 2025. This chart shows the rates payable on and after the 31 March deadline:

Rachel Reeves also announced changes to first-time buyer’s relief. This currently sees first-time buyers benefit from a discount on property below £625,000. Eligible first-time buyers don’t pay Stamp Duty on the first £425,000 and benefit from a lower rate (5%) on the portion of the property valued between £425,001 and £625,000.

From 1 April 2025, the threshold falls to £300,000 so first-time buyers will pay Stamp Duty at 5% on the portion between £300,001 and £500,000. If the property price is above £500,000, first-time buyer’s relief will not apply.

If you’re looking to buy a first home in the coming months, you could save by completing the purchase before 1 April. Our expert team of mortgage brokers is on hand to help so get in touch now.

It’s also worth mentioning that the Stamp Duty surcharge for second properties has increased by 2%.

The “Higher Rate for Additional Dwellings” Stamp Duty surcharge had stood at 3%. Reeves used her Autumn Budget to announce that this would rise to 5%, with the change effective from 31 October 2024.

Get in touch

If you have any questions about the property market, an imminent home move or your mortgage, speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it. The Financial Conduct Authority does not regulate buy-to-let (pure) and commercial mortgages. Think carefully before securing other debts against your home.