On 19 July 2022, the village of Coningsby in Lincolnshire recorded a temperature of 40.3°C. This marked the highest temperature ever recorded in the UK.

As the heatwave hit, the Met Office declared it a “milestone in UK climate history”.

The following week, scientist and environmentalist James Lovelock passed away. Creator of the Gaia hypothesis, Lovelock posited that our planet, and all life within it, is a single organism working to preserve the optimum conditions for life.

Lovelock’s experiments, theories, and calls for change helped to shape our modern understanding of the climate emergency.

But what does climate change mean for the global economy, and your own finances, now and in the future?

Keep reading to find out.

The planet is fast approaching an irreversible tipping point

Lovelock’s 1979 book Gaia was almost New Age when it was released. Since then, the theory has gained ground toward scientific orthodoxy.

Just a few months before his death, Lovelock predicted that the planet was in its last 1% of life and suggested that some of the worst impacts of climate change are already unavoidable.

This is a view all but confirmed by the European Commission, which worries that limiting global warming to 1.5 °C – part of the Paris Agreement – will soon become impossible.

But all is not lost. We can all act now to prevent recent weather extremes from becoming the new normal.

But what about the impact of climate change on the economy?

The impact of climate change will vary wildly across the global economy

GDP will drop

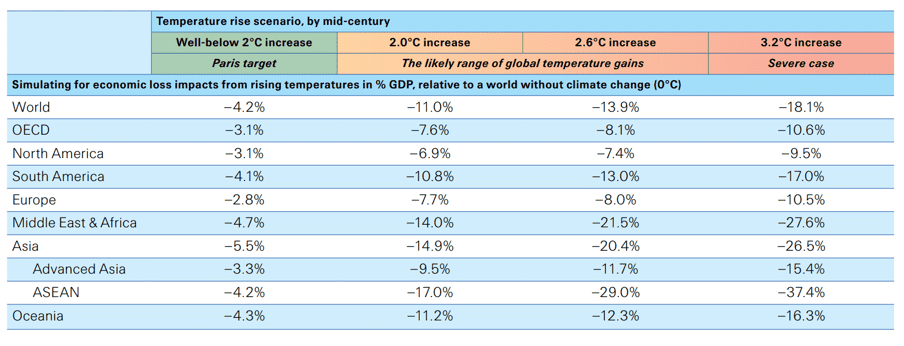

According to the World Economic Forum, climate change could wipe 18% of GDP from the worldwide economy by 2050. This figure is based on no action being taken to combat climate change.

The following chart shows global GDP changes based on whether the Paris Agreement targets are met, and if not, the severity of the deficit.

Source: World Economic Forum

The US, Canada, and the UK and Europe could lose around 10% of their GDP if temperatures rose by 3.2°C, the most severe case with no action taken.

South America could lose 17% in this scenario, with China forecast to lose 24%.

Inflation will likely rise

Climate change could lead to initial growth for some economies in the medium term.

However, rising sea levels, extreme weather events, and mass migration away from the most at-risk places will eventually lead to supply and labour issues and likely food shortages.

In the longer term, these could lead to higher and sustained inflation.

The Office for National Statistics confirms that inflation is currently at a 40-year high of 10.1% for July 2022. This marks the first time the Consumer Price Index has hit double figures since 1982.

As the climate crisis continues, it’s not just extreme weather that could become the new norm.

Developing countries will be most at risk

As temperatures continue to rise, the effect across the globe will depend on many factors, including height above sea level, infrastructure, and chief industries.

The biggest impact will be felt by the developing world.

Likely to be especially affected are countries like Malaysia, Thailand, and Indonesia, which are most susceptible to the physical changes of the climate crisis.

The UK’s higher latitude could help protect it in the medium term

We have already seen the effects of rising temperatures at home.

In July, air travel was disrupted as Luton airport’s runway melted, a wild gorse fire broke out at Newgale Beach in Pembrokeshire, and London’s fire department experienced its busiest day since the second world war.

As well as having robust infrastructure, the UK’s latitude could protect it from the worst damage. The flood risk, though, especially in low-lying areas in the southeast and Humberside, for example, is set to increase dramatically over the next few decades.

There are reasons to be hopeful too

Public consciousness and government engagement on climate issues is at its height. Nearly 200 global parties signed the Paris Agreement, and although work to meet its targets is slow, it is ongoing.

In the short term, summer heatwaves are likely to become more regular and our winters cooler, but the effects on the economy will be slow.

With so much uncertainty in the world right now, there is no better time to get to grips with your finances. We can help you to plan for the unexpected but remember to stay calm and not panic. If your long-term goals haven’t changed then your financial plans don’t need to either.

Get in touch

If you’d like to revisit your long-term plans, possibly to live more sustainably or opt for “green” investments, we can help. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.