At Fingerprint Financial Planning, we have decades of combined financial experience, giving you confidence when times are good, and reassurance when they are not.

Over the last few months, shocking scenes have emerged from Ukraine in the wake of Russia’s invasion. A growing human tragedy, the war has also affected global economies.

Experience tells us that the stock market hates uncertainty.

The invasion, along with the economic sanctions imposed on Russia and its oligarchs, has seen markets tumble. But what does this short-term volatility mean for your investments and how should you react?

Here are three important factors to consider.

1. Global events can result in market drops, but short-term volatility is to be expected

Since the start of 2022, rising inflation, continuing issues with global supply chains, and world economies still recovering from the coronavirus pandemic have all been influencing the markets.

The war in Ukraine added another layer of uncertainty and saw stock market values drop.

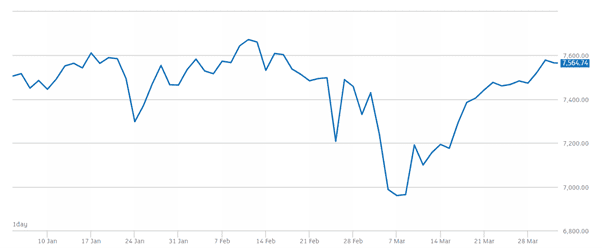

Here is the FTSE 100 since the start of the year:

Source: London Stock Exchange

Daily fluctuations in the market are clear, as is the sharp drop coinciding with the Russian invasion on 24 February and the pronounced dip that followed at the start of March as the war continued.

While the cause of the drop is shocking, a drop in the market in itself is not. Here’s a look at the FTSE 100 over the last five years:

Source: London Stock Exchange

The impact of the coronavirus pandemic – from which the UK economy is still recovering – is clear in March 2020. Although the recovery to pre-pandemic levels has been slow, it’s important to note that the Covid drop was the sharpest in 30 years.

Short-term blips are to be expected. Over the past three decades, many events – from the first Iraq War to the 2008 global financial crisis – have caused short-term drops.

Staying calm, patient, and invested at these times is crucial if you’re to see the benefits of future rises.

2. The long-term trend of the market is upwards, so stay focused on your goals

Returning to the FTSE 100 for a final time, we can see the general upward trend of the market since 1990.

Source: London Stock Exchange

When we recommend investments to you, we will only ever do so where you have a definite, long-term goal in mind, usually with a term of 10 years or more. This is specifically so that your fund can ride out periods of short-term volatility.

Remember that investment isn’t a race to see who can make the largest returns in the shortest space of time. Instead, it’s about adopting a risk-managed approach to help you reach your goals while taking the minimum amount of risk.

Staying calm and patient means not checking your fund’s value daily, and avoiding trends that could be damaging to your long-term goals.

3. Your investment portfolio is diversified to spread risk

This time last year, we looked at ‘Diversification: How to avoid putting all your eggs in one basket this Easter’ and the role of diversification is just as important in 2022.

Simply put, diversification is a way to spread investment risk by ensuring that your portfolio comprises investments across asset classes, sectors, and geographical regions.

Diversified asset classes could include a mixture of low-risk government bonds and higher-risk shares. Some sectors and geographical regions are also higher-risk than others. Using diversification to spread risk means that a drop in one area of your portfolio has the chance of being countered by a rise elsewhere.

Get in touch

Russia’s invasion of Ukraine shocked the western world and will continue to have an economic impact for some time to come.

Staying calm, avoiding emotional knee-jerk reactions, and focusing on your long-term goals are key to successful investment. Your long-term plan is designed to weather the storm of short-term volatility, whatever its cause, but if you feel like you want further reassurance, or you’d like to discuss any aspect of your investments, contact us now.

Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.