The most recent forecasts from the International Monetary Fund (IMF) confirmed an improved economic outlook for the UK in 2023.

Rather than the recession (or projected growth of -0.3%) originally calculated, April’s figure increased their growth projection to a modest 0.4%.

While avoiding a recession is good news, it will come as little comfort to those feeling the effects of the cost of living crisis.

Rising energy bills, slow-to-fall inflation and mortgage rate hikes are all taking their toll.

But when will the current crisis end?

1. Inflation is falling… but how quickly?

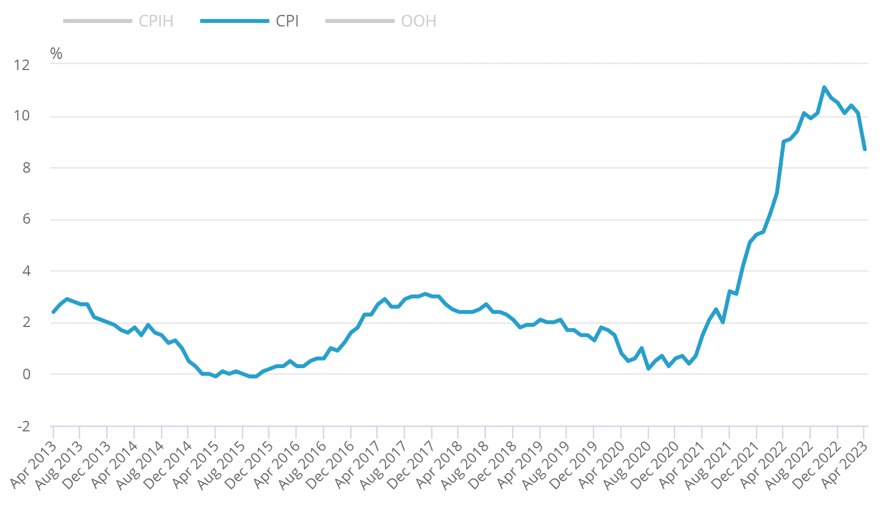

The Consumer Prices Index (CPI) began to rise in the summer of 2021 when the UK emerged from Covid lockdown.

It rose steadily from that point and eventually peaked in October 2022, at a 41-year high of 11.1%.

Source: Office for National Statistics (ONS)

It has since begun to fall and the latest figures show the CPI at 8.7% for the 12 months to April 2023.

This is still higher than expected, and considerably higher than the Bank of England’s (BoE) 2% target. But even that doesn’t tell the whole story.

Inflation is based on the price of a set basket of goods, but your real-life basket will be individual to you. That means your personal inflation figure could be higher or lower than the figure reported, depending on the goods and services you buy most.

For the year to April 2023, for example, UK food inflation was a massive 19.1%, one of the highest in Europe. Fuel bills, too, remain high.

Inflation is falling but remember that even if the CPI does begin the sharper decline the BoE predicts, this doesn’t mean that prices will start to fall. It just means they will be rising less rapidly.

The BoE has predicted that inflation could return to its 2% target by late 2024.

2. The BoE raises its base rate again… but how high can it go?

The BoE set the UK’s base rate and can use this power as a tool to help control inflation.

Increasing the cost of borrowing (while making saving more attractive) is intended to encourage people to spend less and save more, lowering demand, and so the cost of goods.

Back in 2021, consumers emerged from lockdown with “accidental savings”, accrued during enforced periods at home with reduced opportunities to spend their hard-earned cash.

The rush on the high street when lockdown was lifted, though, coincided with global supply chain issues, labour shortages, and then the war in Ukraine, which inflated already rising fuel prices. Inflation rocketed and hasn’t yet come back under control.

This is despite the BoE raising its base rate at 13 consecutive meetings of its Monetary Policy Committee (MPC). It has risen from 0.1% in December 2021 to 4.5%.

3. Mortgage turmoil is high but affordability

With the cost of borrowing rising, the mortgage market is also seeing the continued effects of the September 2021 mini-Budget (and lingering fallout from Covid).

The government’s “Growth Plan” spooked markets. This led to mortgage rate rises and many mortgage products vanishing overnight.

Even before the latest BoE base rate hike, the Guardian reported that some of NatWest’s buy-to-let mortgage deals increased by as much as 1.57%, while Santander joined other providers when it removed deals for new borrowers.

All of this has led to Mortgage Strategy reporting that mortgage rates are set to cost homeowners an extra £9 billion this year, with providers preparing for the BoE to raise the base rate as high as 5.5% by the end of the year.

Mortgage Solutions, meanwhile, confirms that mortgage affordability is at its lowest level since 2008.

At Fingerprint Financial Planning, our mortgage advisers are on hand to answer any questions you have, helping you whether you are:

- A first-time buyer

- Looking to remortgage

- Seeking advice on buy-to-let.

Be sure to speak to us if you have any concerns.

Get in touch

As inflation falls only slowly, base rates continues to rise, and the housing market remains in turmoil. The cost of living crisis may be with us for the foreseeable future but the IMF’s improving forecast is a glimmer of hope. Remember, too, that we are always by your side.

If you are worried about the effect of the cost of living crisis on your plans, or you need help with your mortgage, we can answer any questions you have so speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.