A recent report by Canada Life has found that around 40% of UK pensioners have some form of retirement regret.

From beginning saving too late, to dipping into their pot early, and failing to manage debt during their career, there are plenty of regrets you could take into your retirement.

But expert financial advice can help. Keep reading for a closer look at some of the biggest regrets British pensioners have, and how working closely with Fingerprint Financial Planning could help you to avoid them.

1. Starting saving too late and not saving enough

Perhaps unsurprisingly, one of the biggest regrets that UK pensioners have is entering retirement with less money in their pot than they hoped.

Of those surveyed by Canada Life, 17% answered that they wished they’d increased their pension savings while they were working.

At Fingerprint, we will always advise you to start thinking about your retirement early. This means considering when you want to retire and the sort of lifestyle you want to lead.

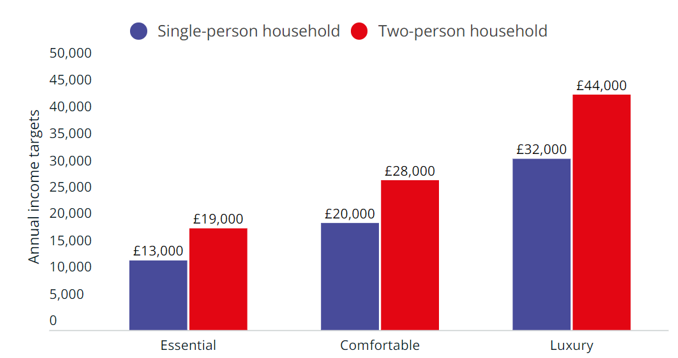

Which? breaks down the annual cost of different levels of retirement comfort.

Source: Which?

It finds that while £19,000 a year might cover the basics for a two-person household, a luxury lifestyle will require an income of £44,000.

The earlier you start saving, the longer you’ll have to contribute, hopefully leading to a larger pot and a greater chance of investment returns. A long-term investment also means more time for compound interest to take effect.

Under current auto-enrolment rules, you must contribute at least 8% of your earnings, with 5% paid by you and the remaining 3% covered by your employer.

Remember, though, that this might not be enough to pay for the lifestyle you want. Consider upping your contributions if you can afford to and remember that your employer might be willing to match your increase, so always ask the question.

2. Retiring too early or dipping into your pension savings earlier than planned

A recent survey from Just Retirement has found that 28% of over-55s had dipped into their pension before they retired. This can have huge ramifications for the money you have saved.

Early retirement means your pot needs to stretch further, especially difficult amid a cost of living crisis. You’ll also need to think about your longevity.

As UK life expectancies rise, the length of time we spend in retirement is also increasing. If you retire today, you might have a 30- or even a 40-year retirement. It’s unlikely, though, that you’ll spend all those years in perfect health. More likely is that you’ll need to pay for some form of later-life care.

Retiring earlier than planned could mean you run out of money when you need it most.

While some people regret dipping into their funds early, some survey responders had taken a bigger plunge and opted for full early retirement.

You might have read our 2022 article ‘How to avoid “unretirement” as the cost of living crisis continues’. In it, we looked at how rising living costs were forcing those in retirement back into work.

While “unretiring” is a perfectly acceptable decision if made for the right reasons, the Guardian found that almost 70% of “unretirees” had been forced onto it for financial reasons.

3. Not clearing debt, including a mortgage, before retirement

If you can afford to, consider entering retirement debt-free. This has the obvious advantage that all of your retirement income can then be spent providing you with the lifestyle you want.

At Fingerprint, we always take the time to understand you and your circumstances and there won’t be one “right” answer for everyone. We might, though, be able to help you clear high-interest debt or balance overpaying a mortgage with potential early repayment charges levied by your lender.

If your personal circumstances make retiring debt-free a challenge, we might help you look into downsizing or equity release (if you are over 55).

Our team of financial planners and mortgage advisors is here to help you from cradle to the grave so whatever financial issue you’re facing, we’re here for you.

Get in touch

By working with a team of expert finance professionals, you’ll know that your money, and your retirement plans, and in safe hands. If you have any questions, speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance. The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.