House prices in Great Britain could be set to increase by 3.5% between 2022 and 2024, according to figures published in the Guardian recently.

Sales are expected to hit a decade-long high in 2021 after a bumper summer, with average prices 4.5% higher than at the end of 2020. But continued demand for increased freedom – a result of cramped pandemic lockdowns – means that the “race for space” is set to continue.

Whether you’re a first-time buyer, a property investor, or you are considering buy-to-let for the first time, what does the future of the property market mean for you?

The impact of coronavirus on property market forecasts

18 months on from the market freeze at the outbreak of the pandemic and the first nationwide lockdown, the market has performed more strongly than expected.

One factor in price growth has been the “race for space”. Increased interest in properties with gardens and outdoor spaces – potentially convertible into offices – highlighted the shift to homeworking and the importance of fresh air, and even, maybe, a slower pace of life.

As home working looks set to continue, the end of the commute has also led to a shift in desirable areas.

This move, and the changing desires of home buyers, has meant that while the average UK house price fell by £10,000 in July compared with the previous month, recent data from the Office for National Statistics (ONS) shows annual price growth of 8%.

The chancellor’s Stamp Duty holiday also played a large role in keeping demand for property high.

What is the outlook for the property market?

House prices

Estate Agent Hamptons is forecasting price growth for Great Britain of 3.5% in 2022, 3% in 2023 and then 2.5% in 2024. That’s a total of 13.5% from the start of 2021 to the end of 2024.

The north-east of England is expected to outperform the rest of Great Britain, with property values rising by 6.5% this year, followed by increases of 4% and 6% a year between 2022 to 2024.

London, meanwhile, is likely to see the smallest rises, with prices forecast to increase by 1.5% this year and 1% in 2022.

Mortgage rates

The news is good for first-time buyers. The agency predicts rates for all borrowers will “hit rock bottom”, particularly helping first-time buyers.

Low rates, along with the new Help to Buy: Equity Loan Scheme launched 1 April 2021 should be a boost to first-time buyers, at least until the scheme ends in March 2023. The government will lend homebuyers up to 20% of the cost of a newly built home, rising to 40% in London.

Buy-to-let

Figures from Shawbrook Bank published in Which? suggest that a third (34%) of landlords are looking to purchase new properties in the next 12 months. Of these, 10% expect to expand the area in which they are willing to buy, largely as a result of changing tenant priorities – gardens, rural locations, less pressure on commutability – since the outbreak of the pandemic.

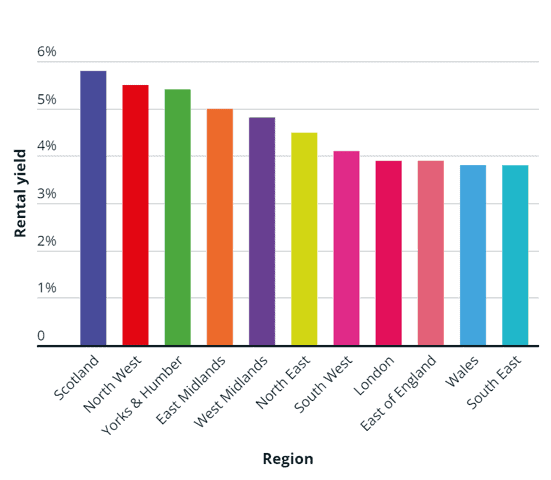

According to the report, north-east England is a popular choice, due in part to its high rental yields.

Source: Which? and Shawbrook Bank ‘Changing Face of Buy to Let’ report, August 2021

The south-east, meanwhile, with its higher initial outlay, is characterised by poorer yields.

What the property market forecasts mean for you

While these recent property market reports are forecasts, therefore providing only a snapshot of what the next few years could bring, they do signal reasons to be cautiously optimistic.

How the state of the property market – and the full impact of coronavirus on the sector – affects you will depend largely on your place within the sector.

First-time buyers, investors, and those looking to move into buy-to-let for the first time could be set to benefit. Low interest rates and more mortgage options will need to offset rising house prices in the face of sustained demand.

For potential landlords meanwhile, changing priorities mean that new locations and markets could open up, making now a great time to think about entering into buy-to-let.

Get in touch

At Fingerprint Financial Planning, our expert financial planners and mortgage advisers are here to assist you whether you’re a first-time buyer or you are keen to expand your buy-to-let portfolio.

If you would like to discuss any aspect of your move into the property market or the impact of this on your long-term financial plans, get in touch by emailing hello@fingerprintfp.co.uk or call 03452 100 100.