Over the next 30 years, the baby boomer generation is expected to pass on wealth valued at around £5.5 trillion. The so-called “Great Wealth Transfer” will be the biggest movement of wealth in UK history.

If you are retired or approaching retirement, you’ll have some big decisions to make about how and when you pass on your wealth. You’ll also want to be sure that your loved ones are in the best position to make prudent use of it.

That’s where intergenerational planning comes in.

Keep reading for some important factors to consider when planning your own wealth transfer and how involving other generations is key.

Considering an inheritance on death

Traditionally, the most popular way of passing on wealth has been through an inheritance on death.

A will is the best way to make your wishes known and to ensure they are carried out after you are gone.

If you don’t have a will in place, you should arrange one as a matter of urgency. If you haven’t revisited it in a while, you should also do so now. Life events and changes in circumstances can alter your wishes and these changes must be reflected.

The financial and non-financial benefits of giving while living

The “giving while living” movement has gained traction over recent years. The financial and non-financial benefits associated with it make it easy to see why.

The financial benefits of giving while living

Inheritance Tax (IHT) is paid at 40% on the value of your estate that exceeds the nil-rate band (£325,000 for the 2022/23 tax year).

By gifting to loved ones during your lifetime you can lower the value of your estate and reduce the IHT liability you leave behind.

You can gift any value you like during your lifetime but the gift will be tax-free only if you live for a further seven years. The gift is known as a “potentially exempt transfer” (PETs).

After seven years the gift falls outside of your estate for IHT purposes so giving while living increases the chances of the gift being tax-free.

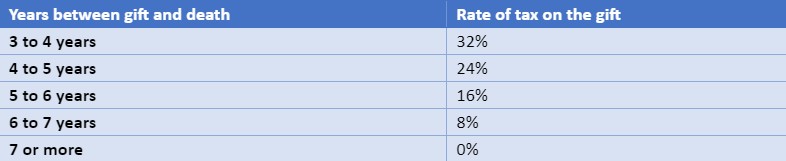

Death within seven years means tax is payable on a sliding scale known as “taper relief”:

Source: HMRC

HMRC also allows you to make certain other gifts tax-free each year.

There is no IHT on gifts you make to a spouse or civil partner, as long as they permanently live in the UK, for example.

The annual exemption, meanwhile, allows you to give away up to £3,000 in gifts tax-free each year. This exemption can be carried over, meaning you could gift £6,000 in the 2022/23 tax year if you didn’t use last year’s exemption.

The non-financial benefits of giving while living

Passing on your wealth during your lifetime means that you will still be around to see the difference your gift makes and the joy it brings.

You might also find that passing money on earlier means that your loved ones receive it when they need it most. This might be when they are looking to buy their first home and start a family.

Communication is key to successful intergenerational planning

Intergenerational planning means communicating your wishes to children and grandchildren and getting them involved in the estate planning process.

Ensuring all parties understand your wishes is the best way to prevent those wishes from being challenged. This is especially true if you don’t plan to split your wealth evenly.

You might even introduce loved ones to Fingerprint Financial Planning. That way, you will know your money is in safe hands and that your loved ones are getting the expert advice they need.

Get in touch

If you are in or approaching retirement, now is the perfect time to start thinking about the money you leave behind. If you’re planning your own wealth transfer, we can help to ensure your wishes are known and involve all generations of your family.

If you have any questions about intergenerational estate planning or any other aspect of your long-term financial plans, speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember too that taper relief only applies to gifts in excess of the nil-rate band. If no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.