Christmas can be an expensive time of year, and stressful too. Household expenditure and energy bills rise, and there are visiting relatives and Christmas dinner timings to contend with.

One thing you shouldn’t worry about, though, is your long-term investments.

From tax-raising Budgets to US elections and global conflict, stock markets react to world events in the short term. But over the decades of an investment, these dips become much less important than your mindset, staying calm and focusing on your long-term goal.

Keep reading for three reasons why you don’t need to add your investment portfolio to your list of festive fears.

1. Your investment is long-term to ride out short-term volatility and decrease risk

In the short term, markets can appear volatile. Prices rise and fall daily and financial headlines can, on occasion, lean toward the doom-mongering.

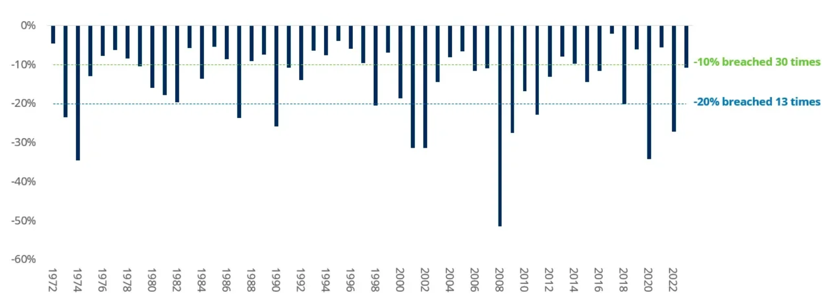

That said, big falls do occur. The below graph shows the biggest stock market drops in the MSCI World Index each calendar year, dating back 52 years. It shows that a 10% drop occurred at some point during the year in 30 of the 52 years. A 20% drop, meanwhile, occurred 13 times.

Source: Schroders

And yet the Index has provided strong annual returns, on average, over this same period.

The general trend of investment markets is upward. While short-term dips will happen, subsequent rises tend to last longer and be more substantial.

Figures from Visual Capitalist looked at the S&P 500 over the 60 years since 1963. The numbers confirm that the average bear market during that period lasted 11.1 months with average losses of -34.2%. The average bull market, meanwhile, lasted for 51 months and saw average gains of 151.6%.

2. Investment returns are more likely to outstrip inflation the longer you remain invested

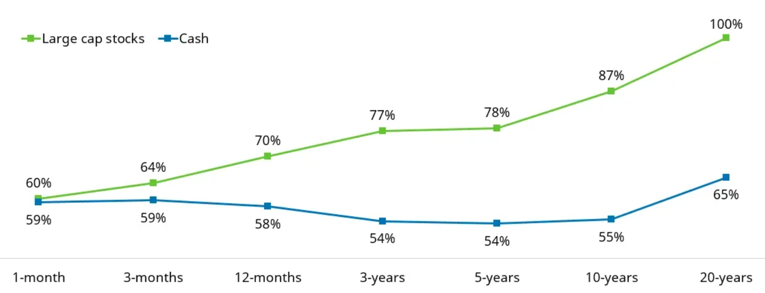

The below graph looks at the percentage of time that US stocks and cash have beaten inflation, between 1962 and 2023.

It’s clear that investments have outperformed cash, when measured against inflation, from every time frame from one month upwards. But the benefits of a long-term investment are also clear.

Source: Schroders

Over a 10-year investment, US large-cap stock beat inflation 87% of the time, in inflation-adjusted terms, compared to just 55% for cash. Extend your investment over 20 years, though, and your fund could beat inflation 100% of the time. That is, there is no 20-year period since 1962 when your investment would’ve failed to beat inflation.

While UK inflation is now under control, at least compared to its 41-year high of a few years ago, it’s still worth remembering that high inflation can erode the real-terms value of your cash, over time.

Note also, that past performance is no guarantee of future success.

3. It’s time in the market not timing the market that counts

This well-known adage might be rolled out often but it remains as true as ever.

Whether through trend chasing, or cashing out when markets fall, trying to time the market can have dire long-term consequences for your investment. You’ll likely find that staying calm and invested is the right option for you.

Emotional decision-making and panicked choices, when markets fall, turn a paper loss into a real one and mean you won’t reap the rewards when markets recover.

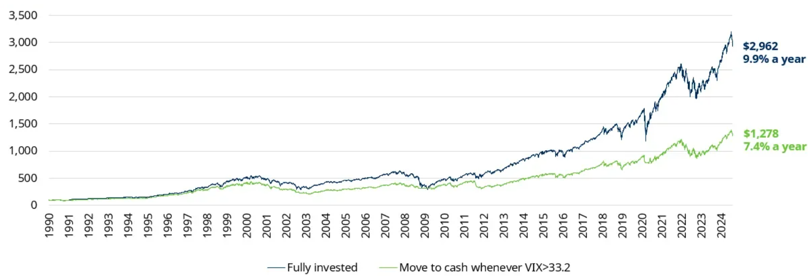

The so-called “fear gauge”, or Vix Index, measures the anticipated level of volatility in the S&P 500, according to investors. It peaked back in May 2022 following Russia’s invasion of Ukraine and more recently, when Japanese markets reacted to growing fears of a US recession.

Selling when the Vix Index is high, though, would historically have been a bad idea, as shown by the below graph. It shows the growth of $100 fully invested in the S&P 500 compared to a move into cash each time the Vix Index rose above 33.2.

Source: Schroders

The figures are based on an investor switching out of the S&P 500 and into cash, daily, whenever the Vix rose above 33.2, and then buying back whenever the Vix dipped below. With costs excluded, staying invested would have returned 9.9% a year compared to just 7.4% gained when funds were switched out.

Ignoring the noise and keeping a cool head, then, is key.

Get in touch

The noise of global conflicts, elections, and policy changes at home can make it all too easy to focus on the short term, but this is rarely the right approach where your investments are concerned. At Fingerprint Financial Planning, our team of experienced professionals can provide reassurance, helping you to stay calm and focused on your goals, whatever happens in the wider markets.

Get in touch and speak to us now by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.