International Women’s Day will be celebrated on 8 March this year.

By raising awareness of bias, stereotypes, and discrimination, the global day aspires to create a world built on diversity, equity, and inclusion.

While this is something we all strive for, the world of finance doesn’t always deliver. And this is especially true where pensions are concerned.

A gender retirement gap still exists in the UK, a result of pay disparities, work patterns, and traditional (or stereotyped) gender roles.

Just two days after International Women’s Day, we celebrate Mother’s Day. We honour our mothers and motherhood in general on this day each year, and yet, interestingly, it is often upon starting a family that the financial gap between the genders first begins to widen.

Keep reading to find out more about this gap and how advice can help to close it.

Wage disparities make pension saving harder for women

The gender pay gap has been decreasing over the past 20 years but progress has been slow.

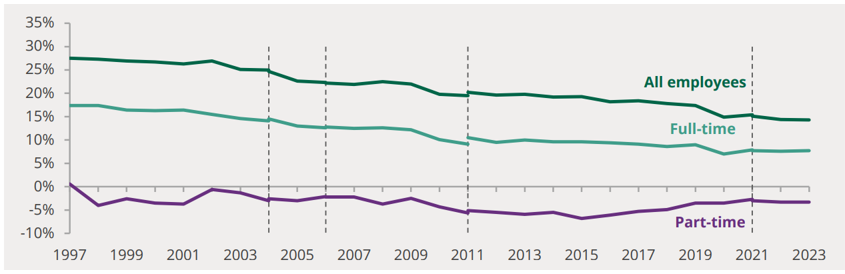

This graph shows the percentage difference in median hourly pay (excluding overtime) for male and female workers:

Source: Office for National Statistics (ONS)

Median pay for all employees in April 2023 was 14.3% less for women compared to men.

It follows that the less you earn, the less you’ll be able to put aside for your pension.

Interestingly, women are paid more for part-time work than men, but there are more women in such roles. These can fall below the threshold for auto-enrolment creating another barrier to pension saving.

Be sure to pay into a workplace and private pension and increase your minimum auto-enrolment contribution if you can afford to. Some employers will match your increase, making a huge difference to the pot you can accrue.

If you receive a pay rise, bonus, or even an inheritance, consider looking after your future self by channelling some of this money into your pension. Do it straight away and you won’t have a chance to miss the extra amount.

Care commitments and starting a family can significantly affect contribution levels

A Scottish Widows ‘Women and Retirement 2023’ report has found that the prevalence of traditional gender roles around care and family means that many women are working fewer hours, with a knock-on for their pension savings.

But these work patterns can sometimes go unacknowledged.

While 50% of fathers stated that childcare was split equally, only 31% of mothers agreed. The data would suggest that it’s mothers who are closer to the mark here, with:

- 37% of mothers leaving a job to look after their children (compared to 18% of men)

- 47% of mothers moving to part-time work to provide childcare, compared to just 15% for men.

These figures also help to explain why the gender pay gap begins to widen from age 30, the average age at which women looking to start a family become pregnant for the first time.

Overcoming an aversion to investing could build higher returns but with added risk

Long-term investment carries the chance for impressive returns but it comes with risk too. Traditionally, women are seen as more risk-averse when it comes to money.

Around 33% more women than men pay into Cash ISAs. This is despite Cash ISAs returning just 0.51% on average during 2021/11, according to the Independent, compared to 6.9% for Stocks and Shares ISAs.

Cash rates have been improving since then but it’s worth revisiting your risk profile and capacity for loss. Remember, too, that the biggest risk can sometimes be not taking enough risk. This was especially true when inflation reached 11.1% back in October 2022 but it remains the case for 2024.

While 42% of men see themselves as investors, only 33% of women have confidence in their investment decisions.

Women need to work for longer or contribute more to retire with the same size pot as a comparable male

A 2024 Gender Pension Gap report from the Pensions Policy Institute (PPI) finds that women retire with pensions pots just 33% the size of those belonging to men.

Scottish Widows, meanwhile, puts the figure at 37%, suggesting that women will retire with private pension pots worth around £150,000 compared to £235,000 for a comparable man.

According to PPI calculations, this means that a woman would need to work an extra 19 years to retire with the same pension as a male counterpart or contribute 14% compared to a male saving just 8% into their pension.

Get in touch

If you’d like to help overcome the gender gap and build a retirement fund to support your chosen lifestyle after work, be sure to speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance. The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.