Post-Covid, and with the UK still amid a cost of living crisis, the link between financial security and emotional wellbeing is better understood than ever before.

At Fingerprint Financial Planning, our fully trained and expert advisers are on hand to help provide financial stability and reassurance. In turn, this provides you with confidence and a sense of control over your financial future.

One way we can do this is to ensure that you have the “right” level of financial protection in place, to protect you and your loved ones should the worst happen. This might be through life insurance or by ensuring you still receive a regular income if you lose your job or are unable to work.

Financial protection has the power to enhance your emotional and mental wellbeing, and even make you more productive at work.

Here’s how.

Financial wellbeing is key to happiness, productivity, and even your company’s profits

The British-American management consultant company Aon recently published its 2022-2023 Global Wellbeing Survey.

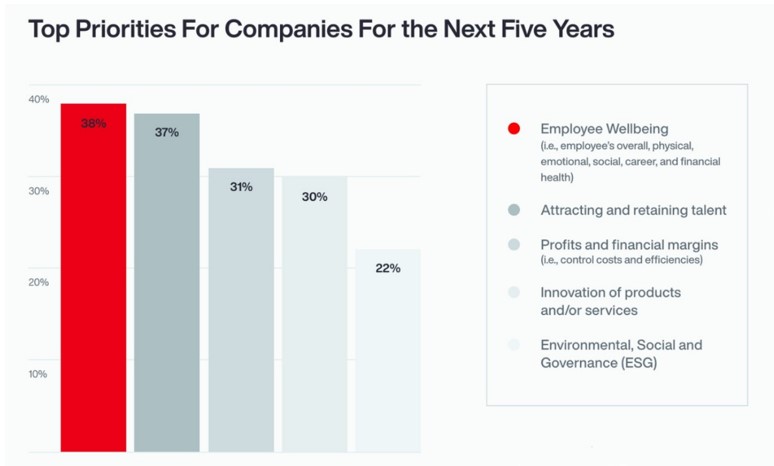

It found that employee wellbeing was the most important priority for companies over the next five years, followed closely by attracting and retaining talent.

Interestingly, ESG (environmental, social, and governance) factors were the lowest priority.

Source: Aon

Nearly two-thirds of those surveyed confirmed that employee wellbeing is more important post-Covid, while around half have seen improvements in employee wellbeing in the last three years.

While only 55% of companies reported having a wellbeing strategy in place in 2020, this number has since risen to 83%.

The report also found that improving employee wellbeing – including physical, mental and financial wellbeing factors – had the power to enhance a company’s performance by anything from 11% to 55%.

The happier, healthier, and more financially settled you are, the more resilient and agile you can be inside and outside of work.

Financial wellbeing is comprised of many different building blocks. These include non-financial ones, like:

- Knowledge of what makes you happy

- A sense of purpose via a long-term goal

- Realistic and achievable life expectations.

It includes financial ones too, like:

- Regular income streams

- Long-term savings and investments

- A safety net against the unexpected.

Alongside an emergency fund held in an easily accessible cash account, protection plays a vital role in the latter.

Financial peace of mind can make a huge difference to your overall wellbeing

The unexpected can strike at any time. But what would happen to your financial dependants if your income was suddenly cut off?

If you and your family would struggle to pay your mortgage or utility bills, or even keep a roof over your heads, you might need to think about getting yourself covered.

A few simple forms of financial protection could make a huge difference.

Income protection

Income protection usually pays a percentage of your full wage if you are unable to work due to an accident or illness. This could help to pay household bills and mortgage repayments. It also provides peace of mind.

Critical illness cover

Critical illness cover provides a one-off payment if you are diagnosed with certain conditions listed on the policy. These might include a heart attack, stroke, or certain cancers, as well as conditions like multiple sclerosis and Alzheimer’s disease.

If you are unable to work due to illness, the one-off lump sum to cover medical bills or house modifications could prove invaluable.

Life insurance

There are many different types of life insurance so be sure to speak to the expert before you decide on the right one for you. Just be sure you consider having some in place, especially if you have dependants who rely on you financially.

Remember that if you have previously held life cover through an employer, this might have ceased if you subsequently changed jobs, so be sure to check in with your protection provisions now.

Get in touch

Protection is just one of the building blocks that make up your overall financial wellbeing, but it’s an important one.

If you would like help revisiting your current financial protection provisions, or you’d like to discuss the financial ramifications of losing or changing your current job, we can help. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

Protection plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse. Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from a product provider and will be explained within the policy documentation.