With the festive season once more upon us, you might be looking for gift inspiration for a child or grandchild.

Cash gifts are always a good option and they could also help you lower a potential Inheritance Tax (IHT) liability or make regular gifts into a child’s pension or Junior ISA (JISA).

Keep reading to find out how to make the most of HMRC gifting exemptions this Christmas, and why an investment might be the gift that keeps on giving.

Cash gifts made during your lifetime can be incredibly tax-efficient

Christmas might not be the obvious time to think about your mortality and estate planning, but cash gifts can be incredibly tax-efficient.

This is because you can make as many cash gifts during your lifetime as you like, IHT-free, as long as you live for seven years after the date the gift is made. These gifts are known as “potentially exempt transfers (PETs)”.

Giving while living is a valuable alternative to gifting only in your will as gifts made during your lifetime not only benefit your recipient but also lower the value of your estate for IHT purposes.

There are also added benefits:

- You’ll still be around to see the difference your money makes to your loved ones’ lives.

- The gift might arrive when your recipient needs it most – when starting a family or buying a first home, for example.

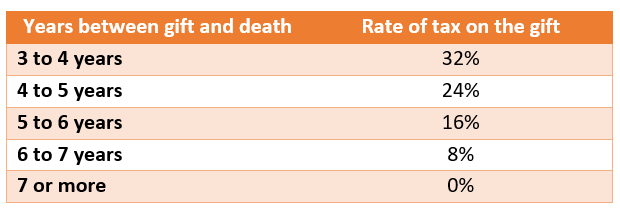

It’s important to note that if you die within seven years of making a gift, it will form part of your estate for IHT purposes. If you die within three years of making the gift, IHT is payable at the full 40%. If you survive for between three and seven years, though, tax is payable on a sliding scale. This is known as “taper relief”.

Source: HMRC

There are, though, some ways to make gifts that are tax-free from the moment the gift is made.

HMRC has several gifting exemptions so be sure to make the most of them

Annual exemption

You can gift up to £3,000 IHT-free in the 2023/24 tax year, thanks to the annual exemption. This limit can be carried forward for 12 months so you can gift £6,000 if you didn’t use this exemption during 2022/23.

The limit applies to you as an individual which means you and your partner could gift up to £12,000 this year.

Small gifts exemption

HMRC classes small gifts as those up to £250. You can make as many of these small gifts as you like during the tax year, as long as the recipient hasn’t previously received your full annual exemption amount.

These gifts are perfect for Christmas presents, allowing you to give a tax-efficient gift to as many recipients as you choose.

You are also allowed to make wedding gifts to a couple, but the amount you can give depends on your relation to the couple and you must make the gift before the wedding takes place. They can gift can be up to:

- £5,000 to your child

- £2,500 to your grandchild or great-grandchild

- £1,000 to another family member or a friend.

You can also usually make unlimited gifts to your spouse or civil partner during your lifetime, as long as they live permanently in the UK.

Consider making regular gifts from your income into a loved one’s pension or JISA

One final HMRC exemption could provide the perfect way to make ongoing contributions to an investment on behalf of a child, grandchild, or loved one.

The “normal expenditure out of income” exemption allows you to make regular gifts from your income, as long as the gift:

- Comes from your normal income

- Is part of your normal outgoings

- Doesn’t detrimentally affect your standard of living.

You’ll need to keep a record of these gifts because HMRC may ask for proof that these criteria have been met.

Get in touch

If you’re looking to give a tax-efficient gift to a loved one this Christmas, you might opt for a one-off cash sum or an ongoing investment that could give them a stable financial future. Either way, we’re on hand to help so speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

The value of investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief. Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.