At the end of the month, as children break up for the Easter holidays, step 2 of the UK’s roadmap out of lockdown is due to come into force. It will allow us to meet in private gardens (up to the “rule of six”) and take part in outdoor sports, as the “stay at home” message ends.

With Easter falling on 4 April this year, this is potentially great news for those planning an Easter egg hunt. The National Trust recently announced their nationwide hunts in collaboration with Cadbury are due to start on 29 March.

We all understand the concept of not putting all your Easter eggs in one basket. But what about its investment equivalent?

Diversification is a vitally important part of your investment portfolio, and handily, it can be explained with the help of a patchwork Easter blanket. Here’s how:

Successful investing is a balance of risk versus reward

To build a successful investment portfolio you’ll need to understand the concept of risk versus reward, as well as being clear on what we mean by “successful”.

There are three key questions you’ll need to ask yourself before you start investing, and they are intimately linked.

What is my long-term goal?

Your long-term goal is the reason you chose to invest in the first place. It might be your retirement or a child reaching aged 18 and heading into further education.

How long am I investing for?

We recommend not investing for less than five years but the longer you can invest – the further away your goal is when you start – the better.

If you are investing for your retirement, you may still have decades before you want to access your funds. You might be investing for a child’s education or to help a grandchild onto the property ladder, in which case you might have a shorter investment term in mind.

What is my attitude to risk?

Your goal will have a bearing on your attitude to risk. You might be willing to take greater risk with your own retirement than with your child’s education, for example.

The amount of risk you take will be personal to you, but it also needs to consider risk versus reward. A successful investment isn’t the one that achieves the highest return in the shortest amount of time. This approach would expose you to unnecessarily high risk.

Instead, success means minimising risk, while giving you the best possible chance of achieving your goal.

The general trend of the markets is an upward one. The best way to take advantage of that general rise is to stay invested. This allows you to consolidate gains over a longer-term while allowing time for your investment to recover from short-term market blips.

Whatever trends or fads steal the financial headlines, your investment should focus on your own long-term goal.

Diversification simply means not putting all your investment eggs in one basket

Diversification is how we spread your investment risk – the investment equivalent of not putting all your eggs in one basket.

Your portfolio will be made of different asset classes, each with its own level of risk attached.

Government-issued bonds will offer a low-risk investment countered by the likelihood of smaller returns. Shares can offer a medium- or higher-risk approach. Investing in business start-ups for example is high-risk, with the possibility of greater returns but the potential for significant losses.

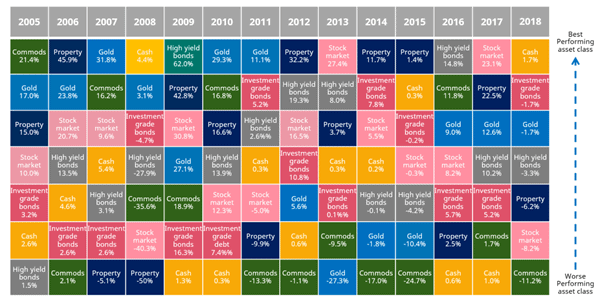

This “Easter blanket of investment” shows the performance of different asset classes over the 15 years to 2018 and highlights why diversification is so important.

Source: Schroders

Investments in the stock market have arguably been the most consistent in terms of performance. Investments in gold, property, and commodities show a larger swing between big gains and significant losses.

Ensuring your portfolio contains the correct mixture of asset classes will help you achieve your investment goal without taking undue risk. As prices of different classes change you might need to think about rebalancing your portfolio to ensure your “optimum mix” is maintained.

We can help you manage your investments effectively so speak to us before you consider any changes to your portfolio.

There is more than one way to diversify

As well as diversifying between different asset classes you’ll also want to build a portfolio that is mixed in other areas.

Different sectors and different geographical regions all have their own patchwork quilts of performance.

By ensuring your portfolio invests in different industries in different parts of the world you can spread your exposure to risk even further. A fall in one sector or location could be offset by a rise in another area.

This spreading of risk gives you the best chance of achieving your investment goals.

Get in touch

At Fingerprint Financial Planning we understand the markets and can use our experience and expertise to make sure we don’t put all your eggs in one basket.

Your highly diversified portfolio will be aligned to your risk profile, focused solely on your goals, and be rebalanced when necessary to ensure it is always right for you.

Whether you want to discuss rebalancing an existing portfolio or investing for the first time, speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or call 03452 100 100.

Please note

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.