The Saturday before Christmas – known as “Panic Saturday” – usually brings the busiest high streets and the most work for overstretched delivery drivers during the whole of the Christmas period.

Waiting until the last minute is rarely a good idea but it could be a bigger problem than ever this year.

Following the longest UK spending slump since 1996, figures published in the Guardian confirm that increased spending on toys and clothes in October saw the total volume of goods bought rise by 0.8%.

With the disruption to global supply chains leaving many consumers fearing a goods shortage, Christmas shopping has started early this year.

Here are just a few reasons why an early start makes good economic sense and could even be emotionally beneficial too.

1. Make use of sales throughout the year

Summer sales typically start in early July. If the purse strings are tight and you’re particularly keen to snap up a bargain, you might consider a summer start in 2022.

January sales also offer a fantastic opportunity to find a bargain. They won’t help you pick up the latest trends or must-have items, though, and you’ll have to wait patiently for up to 11 months before you can give the gift. This leaves plenty of time to forget where you’ve put it too!

Picking up bargains throughout the year not only means you can take advantage of the best prices, but you’ll also spread your expenditure throughout the year, helping make the festive period more affordable.

2. Buy bargains when you see them

If you haven’t started your shopping yet, remember that the sales of early December often have discounts that beat even those available on Black Friday and Cyber Monday.

This year, global shortages make it more important than ever to snap up the gifts you need when you see them.

If what you need is available at a price you are happy to pay, buying them when you see them means you’ll avoid disappointment. Be careful not to pay over the odds though. Research can help here.

3. Starting early means more time for research

Shopping around is hugely important if you’re going to spend sensibly this Christmas. Price comparison sites or Amazon-specific cost trackers like Camelcamelcamel will help you pick up a bargain.

The earlier you start planning your Christmas, the longer you’ll have to track prices and the likelier you are to pick up a bargain. Wait until Panic Saturday on the other hand, and you’ll be paying over the odds and run the risk of being unable to find the perfect gift at all.

4. Planning leads to less stress

If you are a particularly organised person, you might already be shopping throughout the year and spreading the cost of your Christmas.

If you are, you’re probably finding that the benefits go beyond just the economy.

Christmas can be an incredibly stressful time. If you have a specific set of presents to buy or you have a family relying on you to source and cook a Christmas dinner, having a timely plan could seriously reduce the stress you are under as the big day arrives.

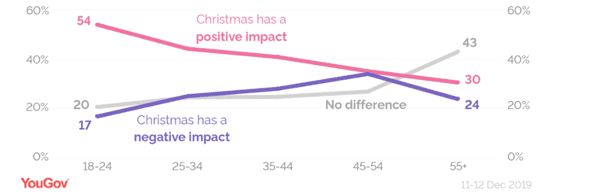

YouGov research back in 2019 found that more than half (51%) of women felt stressed at Christmas. The figure for men was 35%.

Stress levels were also found to vary according to your age.

Source: YouGov

Figures suggest that the older you get, the less likely it is that Christmas will have a positive impact on your mental health.

5. Starting early might mean you don’t need to rely on credit

The Bank of England (BoE) confirms that the average UK household spends just over £2,500 a month. In December, however, we spend almost £740 more, a rise of 29% compared to a typical month.

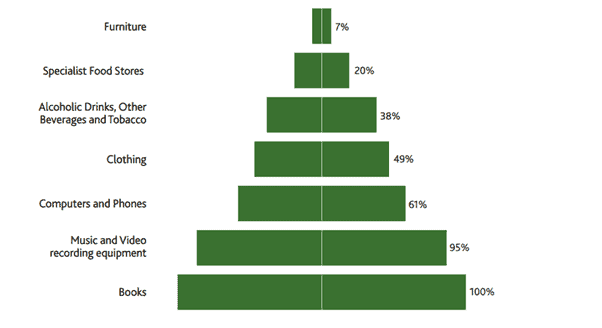

How much do we spend in December compared to a typical month?

(Growth of retail spending in December in selected categories)

Source: BoE

Notes: ONS and BoE Calculations, six-year average

This added expenditure can lead to financial difficulty. While finding ways to spread the cost throughout the year is one solution, others might turn to credit cards.

High-interest debt can mount up quickly so be sure that purchases are absolutely necessary and then shop around for the best deal. Credit cards offering 0% on new purchases for a fixed term will be the best idea, but you’ll still need to ensure you pay off the owed amount before the term expires.

The best way to enjoy Christmas is to plan carefully beforehand and enjoy it within your means.