While it might seem early to start thinking about the end of the tax year, the raft of changes to tax thresholds and allowances announced this year make now the perfect time to begin your preparations.

Here are five things you can do now to endure you get tax year end ready early this time around.

1. Make the most of the pension Annual Allowance

The Annual Allowance is the amount you can contribute to pensions you hold while still receiving tax relief. The Annual Allowance for 2021/22 is £40,000.

Check through your contribution history for the year to see how much you have paid in. If you have unused allowance remaining and can afford to make additional contributions, doing so now gives you more time to spread your contributions while budgeting effectively.

When making your calculations, remember that you can carry forward unused allowance for up to three years, so be sure to check contributions in previous years too.

You’ll also need to be aware of the other allowances that might apply.

2. Factor in the Money Purchase Annual Allowance and the Tapered Annual Allowance

Your £40,000 Annual Allowance can be reduced in some circumstances and it’s important to understand the allowance that applies to you if you are to contribute tax-efficiently.

The Money Purchase Annual Allowance (MPAA) reduces your Annual Allowance to just £4,000. It can be triggered when you take pension benefits using certain flexible options.

You must check whether your desired pension option will trigger the MPAA, especially if you intend to keep paying into other pensions you hold.

You might find that your salary also impacts the allowance that applies to you.

The Tapered Annual Allowance reduces your Annual Allowance by £1 for every £2 of adjusted income that exceeds £240,000 (where your threshold income is over £200,000). The reduction has a minimum allowance of £4,000 applied to those with an adjusted income of £312,000 a year or more.

3. Make the most of your ISA Allowance

Your ISA Allowance for the 2021/22 tax year stands at £20,000, spread across all ISAs you hold, including Lifetime ISAs. Avoid the last-minute rush to use up your full allowance by checking in with your ISA provider now.

This is especially important because your ISA Allowance can’t be carried over, which means that if you don’t use your full subscription before the end of the tax year, you lose it.

Thinking about your ISA now, also means you have more time to budget and less likelihood of miscalculating, either by failing to use your full allowance or accidentally oversubscribing.

4. Make the most of your HMRC annual exemption

Gifting is a great way to lower your Inheritance Tax liability. This is especially useful following with the nil-rate band (£325,000) and the residence nil-rate band (£175,000) freeze, with both currently frozen until at least 2026.

You can gift £3,000 during the 2021/22 tax year, so if you haven’t already made full use of this exemption, do so now. Be aware that the £3,000 is per individual, so your partner can gift £3,000 in a given tax year too. Not only that, but you can also gift any unused exemption from last year.

This is a great way to lower the value of your estate for Inheritance Tax purposes and could help to prevent a liability, even as your house value and share prices rise.

5. Be sure to make the most of your Dividend Allowance

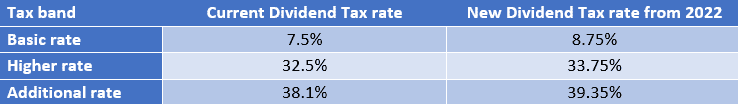

While the Dividend Allowance isn’t changing next year – it will remain at £2,000 – the tax you pay on dividends you receive over the allowance is set to rise.

This may affect the dividends you take next year, so be sure to make full use of your 2021/22 allowance before the tax rise comes into force.

Get in touch

If you would like to discuss the allowances and tax thresholds that apply to you, plus how to make the most of them before tax year end, get in touch by emailing hello@fingerprintfp.co.uk or call 03452 100 100.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.