A recent report has found that only a quarter of high net worth individuals have an Inheritance Tax (IHT) strategy in place, despite nearly half being worried about the next generation’s financial stability.

As a high earner, you’ve worked hard to build your estate. With the so-called “great wealth transfer” well underway, you’ll want to ensure you provide a tax-efficient legacy and that your children are equipped to deal with the responsibility and challenges of a large inheritance.

Long-term financial planning and an ongoing relationship with an expert adviser can help you put the right IHT strategy in place for you.

Keep reading to find out how.

Record IHT receipts and the great wealth transfer mean estate planning is more important than ever

The recent report from FTAdviser confirms that while 45% of high net worth individuals have concerns about the legacy they will leave behind, only 26% have a strategy in place.

These figures are especially worrying in the context of both the great wealth transfer – which will see around £5.5 trillion move between generations over the next three decades – and currently frozen IHT thresholds.

The nil-rate and residence nil-rate bands are currently frozen until at least 2028, meaning more and more families are facing an IHT liability on the death of a loved one.

Indeed, Actuarial Post confirms that Treasury IHT receipts for 2023/24 hit a record £7.5 billion. This marked a £0.4 billion increase compared to the previous year and the third consecutive year of record IHT takings.

A tax-efficient strategy is more important than ever. So, here are three key steps to consider.

1. Giving while living

Gifting to loved ones during your lifetime can be a useful IHT-mitigation strategy, with non-financial benefits too.

Giving while living reduces the value of your estate for IHT calculation purposes and means that you’ll still be around to see the difference your money makes. By gifting earlier in the life of your beneficiaries, you might also find that they receive their inheritance when they need the funds most, when buying a first home, say, or looking to start a family.

Most gifts are tax-free if you survive for seven years or more from the date of making the gift. This is known as the “seven-year rule” with the gifts referred to as “potentially exempt transfers (PETs)”.

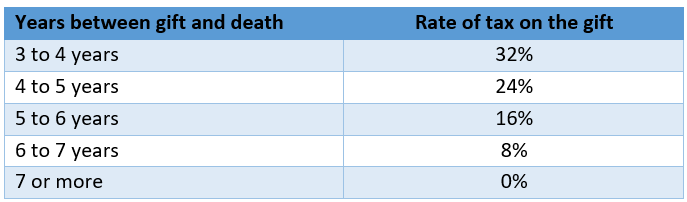

The IHT payable on gift is subject to a taper. Gifts given in the three years before your death are taxed at 40% and the rate reduces the longer you survive.

Some gifts, though, are tax-free from the outset. This is thanks to certain HMRC allowances, which include:

- Your annual exemption, which stands at £3,000 for the 2024/25 tax year

- The regular gifts from income exemption, for regular gifts made from income that do not detrimentally affect your standard of living

- Small gifts of up to £250 (as long as you haven’t already used up the whole of your annual exemption on the same recipient).

Get in touch if you’d like help managing your allowances or if you have questions about gifting tax-efficiently.

2. Setting up a trust

A trust is a legal agreement that allows you (as the settlor) to control who receives your money and when. This process is IHT-efficient because it usually removes assets from your estate after seven years of the trust being set up.

You can appoint yourself as a trustee and, depending on the type of trust you opt for, stipulate who your beneficiaries are, when they can receive your money, and even what they use the money for. For example, you might ensure your children can only access funds once they reach age 18 or stipulate that it is to be used to pay for higher education.

There may still be some IHT to pay, and trusts can be complex to set up, but they can be tax-efficient while helping you maintain control over your wealth.

3. Using protection policies

One simple way to mitigate a potential IHT liability as a high net worth individual is to take out protection, in the form of life cover, to match the expected tax bill.

This might be designed to cover the anticipated liability for your whole estate or to cover the likely charge on a PET if you died within seven years of making a specific gift.

We have already seen how the taper relief on PETs affects the IHT payable. You might opt to match a decreasing term assurance plan to the reducing IHT liability of your gift, helping to keep the cost of cover low while ensuring the liability is met.

Get in touch

With IHT receipts rising and the great wealth transfer underway, ensuring you have a tax-efficient estate plan in place is crucial, especially as a high net worth individual. At Fingerprint, we can help.

If you have any questions about your estate or legacy planning, speak to us now. Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse. Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary by product provider and will be explained within the policy documentation.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief. Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer. The Financial Conduct Authority does not regulate estate planning, cashflow planning, tax planning, Lasting Powers of Attorney, or will writing.