With inflation rising, fuel bills rocketing, and bank interest rates remaining low, turning to investments can offer the potential for inflation-beating returns in the long term, albeit with the added risk that your fund can fall as well as rise.

Certain products, like pensions and Stocks and Shares ISAs, are also incredibly tax-efficient. But short-term stock market volatility might make you hesitant about investing.

The FTSE 100 suffered its biggest drop in 30 years at the outbreak of the coronavirus pandemic and the market’s recovery has been slow.

Here are three reasons why investing could still be a great long-term option, and why patience may be needed.

1. Periods of short-term volatility are to be expected

The first thing to remember is that sudden dips in the market aren’t a surprise. The markets react to real-world events and many factors could cause a period of short-term volatility.

We have already mentioned the March 2020 dip caused by growing uncertainty about Covid-19. The drop can be clearly seen on this graph charting the movements in the FTSE 100 since 1990. But what about the other visible dips?

Source: London Stock Exchange

Of the largest drops in value over the last 30 years, the start of the second Iraq War in 2003 can be seen, as can the global financial crisis of 2008.

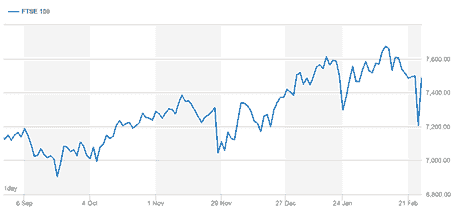

Russia’s invasion of Ukraine resulted in the most recent dip that can be seen more clearly in this short-term graph.

Source: London Stock Exchange

Significant global events can – and will continue to – disrupt consumer confidence, and this will often be reflected as short-term volatility.

2. The general trend of the market is upward

Periods of rising prices (bull markets) tend to last longer than periods of decline (bear markets). Bull market rises also tend to be large enough to offset any previous bear market declines.

Vanguard figures for global stock market prices over the last four decades confirm more than 34 years of rising markets and just five years of decline. The percentage growth during the 34 years far outweighs the small falls during short-term dips.

This mismatch also explains the general upward trend of the market and the need to be patient when short-term dips arrive.

It is for this reason that we would recommend only investing with a goal in mind, and ideally, one that is 5 to 10 years away or more.

Remaining patient is much easier if you’re focused on a long-term goal. The decade-long term is specially designed to allow your money to ride out short-term blips.

Trading provider IG calculated annualised returns for the FTSE 100 (with dividends reinvested) back in 2019. They looked at all possible 10-year holding periods since the FTSE 100’s inception in 1983 and calculated an average annual return of +8.43%.

Global events will have an effect on the stock market but staying focused on the long term and ignoring the noise is the best way to reach your financial goals.

3. Investing is a great way to inflation-proof your finances when times are tough

The Bank of England (BoE) recently voted to increase the base rate to 0.5%, while inflation reached 5.5% for January, its highest figure since 1992.

With savings rates low and inflation high, your cash savings are effectively losing value in real terms.

Patience, and a focus on a long-term goal, has the potential for annualised returns above the best high street bank interest rates currently available. Investing could also help your money keep pace with, or even beat inflation, despite its current high.

Investing comes with the risk that the value of your money can rise as well as fall.

At Fingerprint, we can help you invest in a way that aligns with your goals and your attitude to risk. Remember too, that in the current economic climate, the biggest risk to your wealth might be not taking enough risk.

Get in touch

If you are worried about the impact of short-term market blips on your investments, or you’d like to talk about investing for the first time, get in touch and see how our expert financial planners can help you. Get in touch by emailing hello@fingerprintfp.co.uk or call 03452 100 100.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.