2022 saw UK inflation rocket to a 41-year high of 11.1%, while the Bank of England (BoE) base rate rose at eight consecutive meetings. Its final rise marked the largest single jump since 1989.

While September’s “mini-Budget” left foreign investors (and the prime minister) beating a hasty retreat, Jeremy Hunt’s autumn statement reversed much of his predecessor’s short work. Had the damage to mortgage markets, though, already been done?

As we head into a new year, what does the future look like for the cost of borrowing, your rising energy bills, and inflation over the next 12 months?

Keep reading to find out.

1. Inflation will continue to rise in the short term and then fall sharply from the middle of 2023

The cost of living crisis has been one of the major news stories of the year, with soaring inflation squeezing the household budgets of millions.

The Consumer Price Index (CPI) exceeded the BoE’s 2% target back in May 2021 and has been broadly rising ever since. In July 2022 it reached a 40-year high of 10.1%, marking its first time in double digits since 1982. It currently stands at 11.1%.

Source: Office for National Statistics (ONS)

The ONS has, though, confirmed that inflation could have been higher. Without Liz Truss’s cap on average energy bills, CPI could’ve hit 13.8%.

In its latest statement on inflations rises, the BoE confirmed that it expects inflation to fall sharply in the second half of 2023, for three key reasons:

- The government’s energy bill cap will prevent steep energy rises for domestic and non-domestic energy users.

- Production difficulties and supply chain issues are easing, which should mean that the rising cost of imported goods begins to slow.

- UK demand for goods is expected to fall, which should also curtail price rises.

The BoE expects inflation to return to its target by 2024 so high prices will be with us for some time to come. Be sure to get in touch if you need help managing your household budget or long-term finances.

2. They’ll be good news for savers as interest rates keep rising into 2023

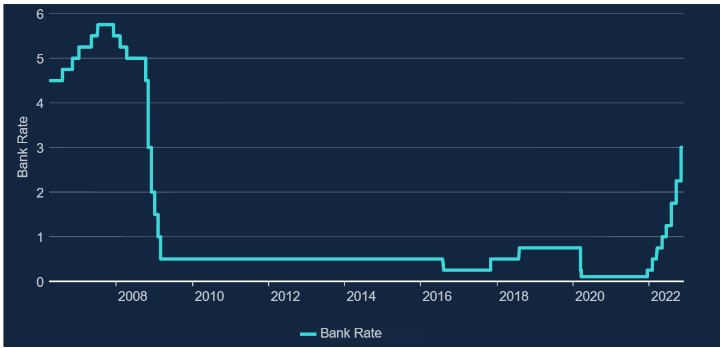

One of the tools that the BoE uses to keep inflation in check is the base rate. The base rate is the interest the BoE charges commercial banks for loans and is used as an interest rate benchmark more generally.

By raising the base rate, the BoE increases the cost of borrowing. This, in turn, encourages people to save. This reduces spending, and thereby demand, and helps to bring inflation back down.

At the outbreak of the coronavirus pandemic, the base rate fell first to 0.25% and then to an all-time low of just 0.1%. It stayed at this rate until December 2021.

Source: BoE

At that point, the base rate began to rise. It did so at eight consecutive meetings of its Money Policy Committee (MPC) and the rate now stands at 3%. This is great news for savers who have had a tough time of it since the 2008 global financial crisis.

While rising inflation is the main cause of the rising base rate, September’s “mini-Budget” also had a huge bearing on the markets.

The unfunded tax cuts announced spooked investors, caused a huge fall in the value of the pound against the dollar, and saw mortgage rates grow almost overnight.

3. You will likely see your mortgage repayments rise, whatever type of mortgage you have

In the week following the mini-Budget, the BBC reported that the number of available mortgage products dropped by 40%. Those that remained, increased in price.

How rising rates affect your payments will depend on the mortgage you currently have.

Your tracker-rate mortgage tracks the BoE base rate so will have been steadily rising during 2022. The base rate is expected to continue rising in the short term, possibly to 3.5% in December and as high as 4.75% by April 2023.

Your variable-rate mortgage will likely have increased as your lender increases their standard variable rate (SVR). If you have a fixed-rate mortgage, though, your payments will remain the same until the fixed-rate period ends, at which point you can expect payments to rise.

Speak to your mortgage adviser if you are worried about the rising cost of payments and we can help.

Get in touch

If you are worried about the cost of living, the effect of market instability on your investments, or your rising mortgage, speak to us now.

Get in touch by emailing hello@fingerprintfp.co.uk or calling 03452 100 100.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it. This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.