The coronavirus pandemic has meant a tough 18 months for many small businesses. The government’s economic response to Covid-19 is bringing its own challenges too, most recently in the form of rises to Corporation Tax and National Insurance.

There are allowances and tax breaks that can help your business run tax-efficiently, but only if you understand them and make the best possible use of them.

Here are 10 essential tax tips for small business owners.

1. Make use of the Personal Allowance

Several taxes and allowances were frozen by the chancellor in his Spring Budget, including the Personal Allowance.

For the 2021/22 tax year, the Personal Allowance – the threshold over which you start to pay Income Tax – is £12,570. The threshold for higher-rate taxpayers is £50,270. Although these amounts mark a rise from the previous tax year, they are now frozen until at least 2026.

Consider paying yourself a monthly salary up to the Personal Allowance. If you have a family business, provide your spouse or partner with the same salary too.

2. Be aware that Dividend Tax is set to rise

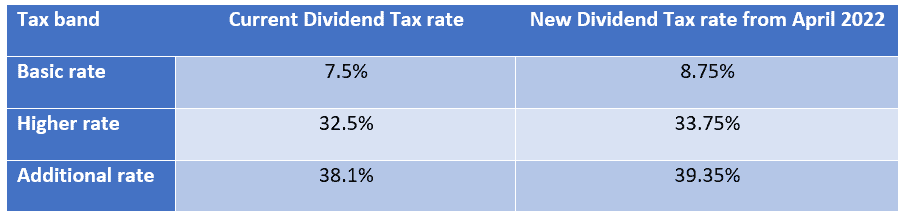

If your company is making sufficient profit, you can supplement your salary through dividends. This has several advantages, but you’ll need to note that the government’s recent raft of tax changes included a rise to Dividend Tax, effective from April 2022.

The £2,000 Dividend Allowance remains, but anyone paying themselves more than this threshold amount will see their tax bill rise.

A basic-rate taxpayer receiving £3,000 in dividends, and therefore paying Dividend Tax on £1,000, would see their bill rise from £75 to £87.50.

As a higher-rate taxpayer, the rise from 32.5% to 33.75% would mean taking £10,000 in dividend payments will cost you £2,700 – that is £100 more than under the current system.

3. Understand how, and if, the Corporation Tax rise will affect your business

Chancellor, Rishi Sunak, also used his Spring Budget to announce a rise in Corporation Tax, effective from April 2023.

The rise – from 19% to 25% – will only affect those companies with profits above £50,000 and even then, it will be tapered. This means that the full increase to 25% will only apply to businesses with profits exceeding £250,000 or more.

Forecasting your potential profit over the next few years should help you plan for any increase in Corporation Tax.

4. Remember the super-deduction

The government also announced a new “super-deduction” that it hopes will increase business investment by 10% over the next two years.

If you are looking to buy plant and machinery (which could include solar panels, computer equipment and servers, vehicles, and office furniture), the super-deduction offers 130% first-year relief on qualifying investments until 31 March 2023.

Also, remember the Annual Investment Allowance (AIA). It currently provides 100% relief for plant and machinery investments up to £1 million until 31 December 2021.

5. Remember your pension

The Annual Allowance is the amount you can pay into a pension while still receiving tax relief. For the 2021/22 tax year, it stands at the lower of £40,000 or 100% of your earnings.

If you are taking an income in line with the Personal Allowance, this could severely limit the employee contributions you can make. You might choose to make employer contributions into your pension.

Your business will receive Corporation Tax relief on the contributions and employers don’t pay National Insurance on pension contributions.

6. Your pension could even help you purchase your business’s commercial property

Both a self-invested personal pension (SIPP) and a small self-administered scheme (SSAS) can be used to help purchase your business’s commercial property.

You can borrow up to 50% of your pension’s value and then lease the property back to your business with rent payable into the pension. You’ll need to charge rent at a commercial rate – with a lease in place – but the rent you pay is tax-deductible as a business expense.

The rules are complex and strict, with additional charges applied if certain conditions aren’t met, so be sure to speak to us if you are unsure.

7. Think about estate planning and Business Relief

While your business, or your share of a business, is included in the value of your estate, Business Relief can reduce the value of that business for Inheritance Tax (IHT) purposes.

Business Relief of 50% or 100% can be applied to some assets and passed on either during your lifetime or via your will.

You can claim relief on property and buildings, unlisted shares, and machinery among other assets.

8. Business Asset Disposal Relief could reduce your Capital Gains Tax (CGT) bill

Formerly known as “Entrepreneur’s Relief”, Business Asset Disposal Relief reduces the amount of CGT you pay when you sell all or part of your business.

If you qualify, you will pay tax at 10% on all gains on qualifying assets.

9. Keep accurate records and meet your deadlines

Keeping track of changing rules around tax and allowances can be tough but maintaining accurate records and meeting deadlines for tax submissions is vital.

Having a clear idea of the tax due each year will prevent you from taking too much money out of your business.

10. Plan ahead

Having a business plan as well as a personal financial plan is crucial.

Understanding the implications of Business Relief on your IHT liability and Dividend Tax on the monthly income you receive will benefit your business, your personal financial stability, and your ability to achieve your long-term goals.

Get in touch

After a tough 18 months, challenges remain for many business owners, but Fingerprint Financial Planning are here to help. If you are worried about the effects of the pandemic or any of the government’s recent tax and allowance changes on your business, speak to us now.

Get in touch by emailing hello@fingerprintfp.co.uk or call 03452 100 100.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.